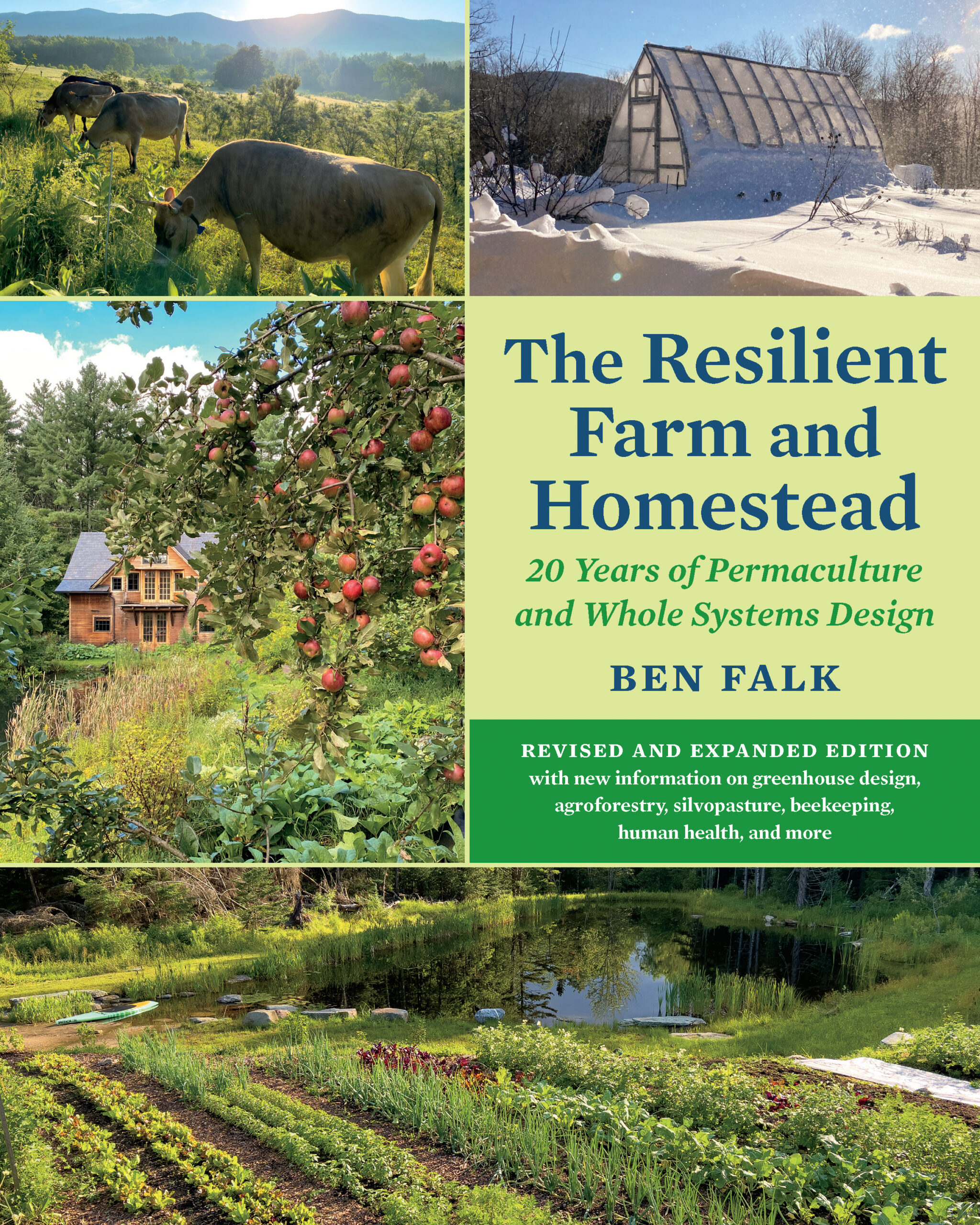

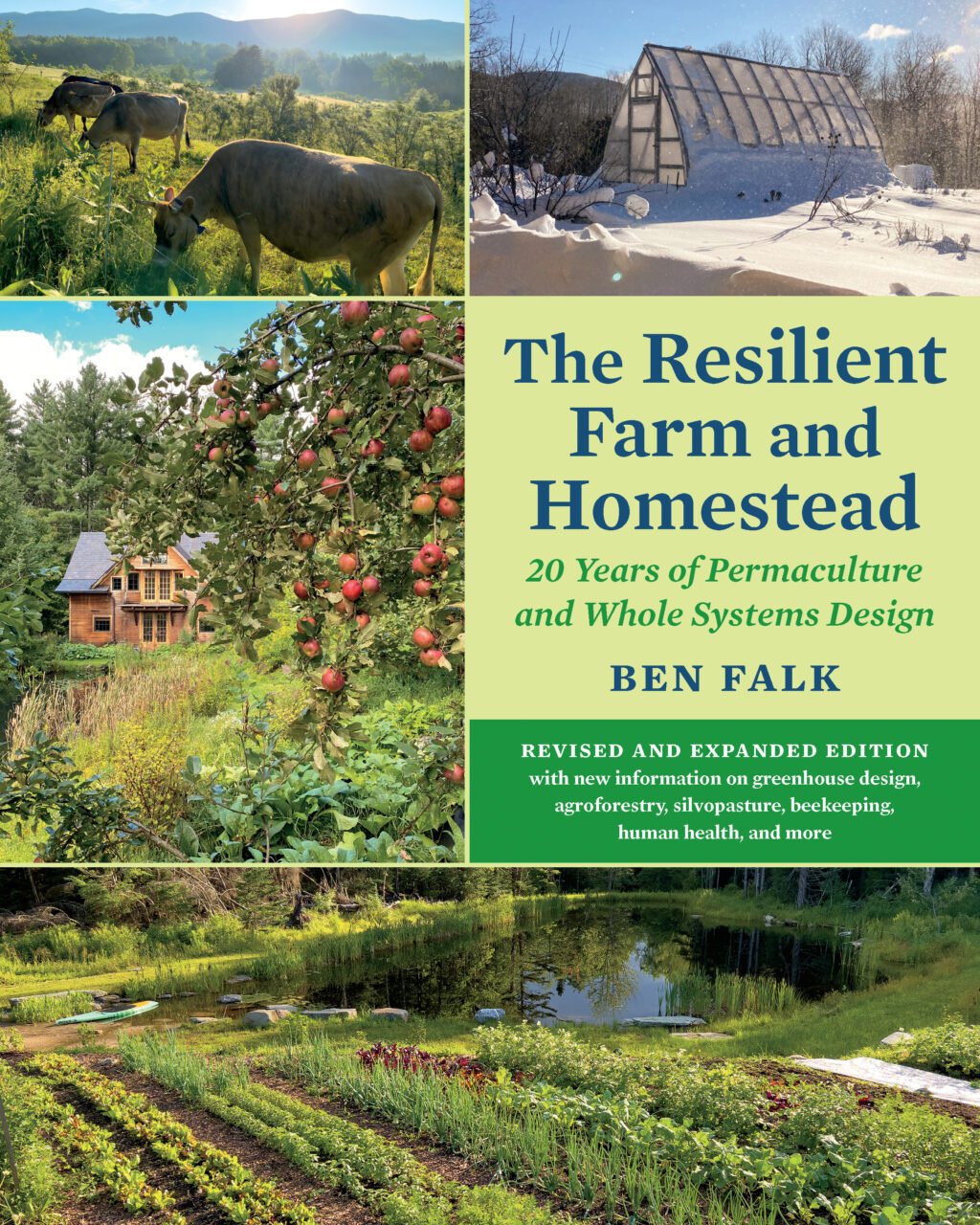

The Resilient Farm and Homestead, Revised and Expanded Edition

20 Years of Permaculture and Whole Systems Design

| Pages: | 352 pages |

| Size: | 8 x 10 inch |

| Publisher: | Chelsea Green Publishing |

| Pub. Date: | February 8, 2024 |

| ISBN: | 9781645021100 |

The Resilient Farm and Homestead, Revised and Expanded Edition

20 Years of Permaculture and Whole Systems Design

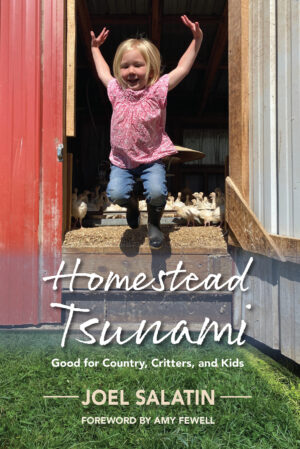

“This is one of the most practical, down-to-earth, dirt-under-the-fingernails, comprehensive explanations of all things homesteading and small farming. Whether you’re just dreaming or an old hand, Ben Falk’s longer experience horizon is invaluable.”—Joel Salatin, cofounder, Polyface Farm; author of Everything I Want to Do Is Illegal

Informed by twenty years of successful land management and the professional design experience of his pioneering firm Whole Systems Design, LLC, author Ben Falk updates his classic text and delivers the definitive twenty-first century systems thinking manual in self-reliance—sure to empower readers to prioritize projects, make positive lifestyle decisions, and take strategic steps toward a regenerative future.

In The Resilient Farm and Homestead, Revised and Expanded Edition Falk describes how he has transformed a degraded hillside in the frigid Vermont climate into a thriving, biodiverse Eden that now provides year-round abundance for his family and community.

First published in 2013, The Resilient Farm and Homestead is a comprehensive how-to guide for building durable and productive land-based systems through the reciprocal interplay of humans and the natural world. In the ten years since he first published this seminal work, Falk has deepened his wisdom in harnessing nature-based solutions for increasingly challenging times, including addressing severe climate disruptions like drought and flood conditions.

The book covers every strategy Falk and his team have tested on the Whole Systems Research Farms over the past two decades and includes detailed information on earthworks, gravity-fed water systems, soil fertility management, growing nutrient-dense food and medicine, fuelwood production, agroforestry, managed grazing, and much more.

Complete with full-color photography and detailed design drawings, The Resilient Farm and Homestead, Revised and Expanded Edition includes new information on:

- Designing greenhouses and microclimates

- Reinvigorating human health and embodying a vigorous lifestyle

- Raising children on a homestead

- Creating failure-proof and resilient energy systems

- Focusing on permaculture beekeeping

- Cultivating proven cold climate plants

- Overcoming analysis paralysis and mastering the art of knowing where to start and when to take strategic risks

- And much, much more!

In an age that feels defined by disconnection, disease, and decline, The Resilient Farm and Homestead, Revised and Expanded Edition offers a roadmap to conquering uncertainty, maximizing efficiency, and creating a bountiful, manageable landscape that will endure.

“Essential reading for the serious prepper as well as for everyone interested in creating a more resilient lifestyle.”—Carol Deppe, author of The Resilient Gardener

“This intelligent, challenging book, rooted somewhere between back-to-the-land idealism and radical survivalism, sees resilience as both planting and building for the use of future generations, but also as preparing food, water, shelter, and the human body and psyche for the onset of any imaginable extreme emergency. . . . The result is a comprehensive, open-ended, theoretical and practical system for a post-carbon-dependent life.”—Publishers Weekly (starred review of first edition)

Reviews and Praise

“I don’t know when I’ve read something in the self-reliance genre with the perception and practice depth of this fabulous book. Ben Falk dares to address common failings but also offers the most common-sense solutions to the struggles all of us face. Magnificent.”

—Joel Salatin, cofounder, Polyface Farm; author of Everything I Want to Do Is Illegal

More Reviews and Praise

“This book is a treasure—one of the few I recommend to any new farmer, homesteader, or just human being who wants to understand ecology, true sustainability, and animal husbandry as it should be. Reading it is like walking along with Ben as he considers what his farm wants, how best to utilize his resources for genuine caretaking and nourishing of the land and all living things it feeds. Ben is a smart and careful guide. He is humble enough to pivot in defeat and observant enough to evolve entire systems into a flourishing, vibrant whole.”

—Tara Couture, Slowdown Farmstead

“The Resilient Farm and Homestead is my favorite contemporary permaculture book. It’s not based on theory, but rather grounded in Ben Falk’s vast experience. It’s inspiring and accessible, with a healthy dose of skepticism that comes from many years of growing, building, and walking the talk. I especially love Ben’s creative approach to working with marginal land and in colder climates, which are generally not addressed in books about permaculture. I’ve assigned this book during countless courses at my carpentry and permaculture school, Wild Abundance, because I think it is the best resource of its kind.”

—Natalie Bogwalker, director, Wild Abundance

“A pragmatic, visionary, and empowering exploration of ecological participation, holistic design, radical simplicity, and future proofing, wrapped within a deep reverence for place and the joy of noble work. Just like a good working design, the second edition of The Resilient Farm and Homestead presents readers with an iterative evolution of the book that has inspired many thousands of aspiring and experienced earth stewards around the globe. Building on the book’s practical vision, principles, and tried-and-true techniques, this new edition overlays the depth of a second decade’s worth of observation, innovation, adaptive wisdom, and trial and error, making it an ever more potent resource for a new generation of people wedded deeply to place.”

—Mark Krawczyk, grower, educator, and applied ecologist; author of Coppice Agroforestry

“In The Resilient Farm and Homestead, Ben Falk gives us a delightful and inspiring description of his years developing a 10-acre permaculture farm in the Green Mountains of Vermont. Readers from regions outside New England, however, should not assume that Falk’s practical, hard-won knowledge will not apply to them. His discussions invariably transcend the specific applications, revealing principles that should be useful to homesteaders everywhere.”

—Larry Korn, editor of The One-Straw Revolution and Sowing Seeds in the Desert by Masanobu Fukuoka

“Ben Falk calls his book about reviving a worn-out hill farm in Vermont an example of resilience and regeneration; I call it pure natural magic. Grow rice in New England? Yes. Heat water to 155°F on cold winter days at a rate of a gallon a minute by piping it through a compost pile? Yes. How about dinner tonight of your own rack of lamb garnished with homegrown mushrooms? Yes. Your choice of scores of different vegetables and fruits even in winter? Yes. Plus, your own dairy products from your own sheep. All the while, the soil producing this magic, on a site once thought little more than a wasteland, grows yearly more fertile and secure from natural calamity.”

—Gene Logsdon, author of Holy Shit and Letter to a Young Farmer

“The Resilient Farm and Homestead is a terrific book. Simultaneously inspiring and practical, Ben Falk takes you from the why to the how—a journey where you will create a present and future filled with optimism and joy.”

—Shannon Hayes, author of Long Way on a Little and Radical Homemakers

“Imagine. Honoring biodiversity in a place we each commit to for the long haul is what it takes to address a rapidly changing climate. Problem solved! Plant trees, let greenness thrive, learn the ways of fungi, be joyful. Ben Falk provides the encouragement and critical know-how to create your own food-producing sanctuary in The Resilient Farm and Homestead. The time is now to engage in healing the land and secure an ongoing future for generations to come.”

—Michael Phillips, author of The Holistic Orchard

“Ben Falk extends the conversation about resilience to deep resilience—resilience from the level of personal attitudes and skills to the design and creation of the maximally resilient homestead. The Resilient Farm and Homestead weaves together permaculture theory as modified by actual practice on a 10-acre Vermont farm with a thorough preparedness guide for times of climate change and greater uncertainties of all kinds and sizes. The book is greatly enhanced by numerous glorious photos of permaculture plantings as hedgerows, rice paddies, people swimming in swale-enclosed ponds, fruit and vegetable harvesting, and foraging sheep, chickens, and ducks. I particularly appreciate that Falk tells us what didn’t work as well as what did. This book will be essential reading for the serious prepper as well as for everyone interested in creating a more resilient lifestyle or landscape.”

—Carol Deppe, author of The Resilient Gardener

“With The Resilient Farm and Homestead, Ben Falk has definitely planted the seeds of a positive, abundant legacy. This book outlines the process of designing one’s homestead with not just the future in mind, but the imminently practical NOW! This one is going on my shelf next to Helen and Scott Nearing.”

—Mark Shepard, author of Restoration Agriculture

Reviews and Praise

“I don’t know when I’ve read something in the self-reliance genre with the perception and practice depth of this fabulous book. Ben Falk dares to address common failings but also offers the most common-sense solutions to the struggles all of us face. Magnificent.”

—Joel Salatin, cofounder, Polyface Farm; author of Everything I Want to Do Is Illegal

“This book is a treasure—one of the few I recommend to any new farmer, homesteader, or just human being who wants to understand ecology, true sustainability, and animal husbandry as it should be. Reading it is like walking along with Ben as he considers what his farm wants, how best to utilize his resources for genuine caretaking and nourishing of the land and all living things it feeds. Ben is a smart and careful guide. He is humble enough to pivot in defeat and observant enough to evolve entire systems into a flourishing, vibrant whole.”

—Tara Couture, Slowdown Farmstead

“The Resilient Farm and Homestead is my favorite contemporary permaculture book. It’s not based on theory, but rather grounded in Ben Falk’s vast experience. It’s inspiring and accessible, with a healthy dose of skepticism that comes from many years of growing, building, and walking the talk. I especially love Ben’s creative approach to working with marginal land and in colder climates, which are generally not addressed in books about permaculture. I’ve assigned this book during countless courses at my carpentry and permaculture school, Wild Abundance, because I think it is the best resource of its kind.”

—Natalie Bogwalker, director, Wild Abundance

“A pragmatic, visionary, and empowering exploration of ecological participation, holistic design, radical simplicity, and future proofing, wrapped within a deep reverence for place and the joy of noble work. Just like a good working design, the second edition of The Resilient Farm and Homestead presents readers with an iterative evolution of the book that has inspired many thousands of aspiring and experienced earth stewards around the globe. Building on the book’s practical vision, principles, and tried-and-true techniques, this new edition overlays the depth of a second decade’s worth of observation, innovation, adaptive wisdom, and trial and error, making it an ever more potent resource for a new generation of people wedded deeply to place.”

—Mark Krawczyk, grower, educator, and applied ecologist; author of Coppice Agroforestry

“In The Resilient Farm and Homestead, Ben Falk gives us a delightful and inspiring description of his years developing a 10-acre permaculture farm in the Green Mountains of Vermont. Readers from regions outside New England, however, should not assume that Falk’s practical, hard-won knowledge will not apply to them. His discussions invariably transcend the specific applications, revealing principles that should be useful to homesteaders everywhere.”

—Larry Korn, editor of The One-Straw Revolution and Sowing Seeds in the Desert by Masanobu Fukuoka

“Ben Falk calls his book about reviving a worn-out hill farm in Vermont an example of resilience and regeneration; I call it pure natural magic. Grow rice in New England? Yes. Heat water to 155°F on cold winter days at a rate of a gallon a minute by piping it through a compost pile? Yes. How about dinner tonight of your own rack of lamb garnished with homegrown mushrooms? Yes. Your choice of scores of different vegetables and fruits even in winter? Yes. Plus, your own dairy products from your own sheep. All the while, the soil producing this magic, on a site once thought little more than a wasteland, grows yearly more fertile and secure from natural calamity.”

—Gene Logsdon, author of Holy Shit and Letter to a Young Farmer

“The Resilient Farm and Homestead is a terrific book. Simultaneously inspiring and practical, Ben Falk takes you from the why to the how—a journey where you will create a present and future filled with optimism and joy.”

—Shannon Hayes, author of Long Way on a Little and Radical Homemakers

“Imagine. Honoring biodiversity in a place we each commit to for the long haul is what it takes to address a rapidly changing climate. Problem solved! Plant trees, let greenness thrive, learn the ways of fungi, be joyful. Ben Falk provides the encouragement and critical know-how to create your own food-producing sanctuary in The Resilient Farm and Homestead. The time is now to engage in healing the land and secure an ongoing future for generations to come.”

—Michael Phillips, author of The Holistic Orchard

“Ben Falk extends the conversation about resilience to deep resilience—resilience from the level of personal attitudes and skills to the design and creation of the maximally resilient homestead. The Resilient Farm and Homestead weaves together permaculture theory as modified by actual practice on a 10-acre Vermont farm with a thorough preparedness guide for times of climate change and greater uncertainties of all kinds and sizes. The book is greatly enhanced by numerous glorious photos of permaculture plantings as hedgerows, rice paddies, people swimming in swale-enclosed ponds, fruit and vegetable harvesting, and foraging sheep, chickens, and ducks. I particularly appreciate that Falk tells us what didn’t work as well as what did. This book will be essential reading for the serious prepper as well as for everyone interested in creating a more resilient lifestyle or landscape.”

—Carol Deppe, author of The Resilient Gardener

“With The Resilient Farm and Homestead, Ben Falk has definitely planted the seeds of a positive, abundant legacy. This book outlines the process of designing one’s homestead with not just the future in mind, but the imminently practical NOW! This one is going on my shelf next to Helen and Scott Nearing.”

—Mark Shepard, author of Restoration Agriculture