5 Recipes to Warm You Up This Winter

Looking for some delicious and simple recipes that will keep everyone in your house warm while snow rages outside? You’ve come to the right place!

The following recipes are some of our favorites and will help you ward off the cold.

Winter Root Veggie Potpie

Winter Root Veggie Potpie

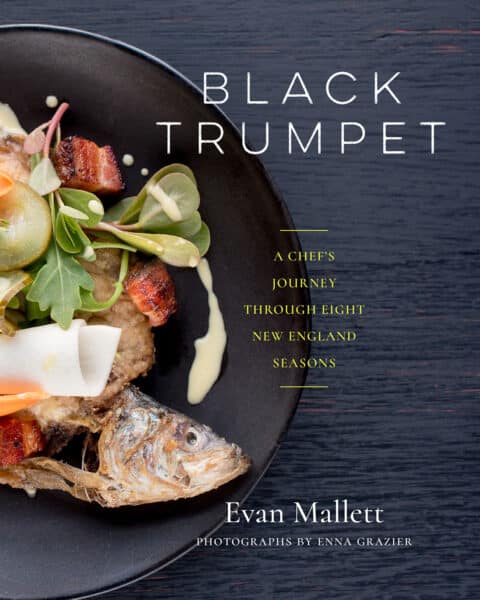

From Black Trumpet by Evan Mallett

Looking for new ways to use those winter root veggies throughout the season? Put your cooking skills to the test with this Root Veggie Potpie recipe!

Cream of Butternut Squash Soup

Cream of Butternut Squash Soup

From Full Moon Feast by Jessica Prentice

During this time of year — when the weather is cold and the sun still sets early — there’s nothing like a good comfort meal to warm you up and boost your spirits. This soup recipe is sure to keep you feeling cozy all season long!

Turkey Egg Rolls With Vietnamese Dipping Sauce

Turkey Egg Rolls With Vietnamese Dipping Sauce

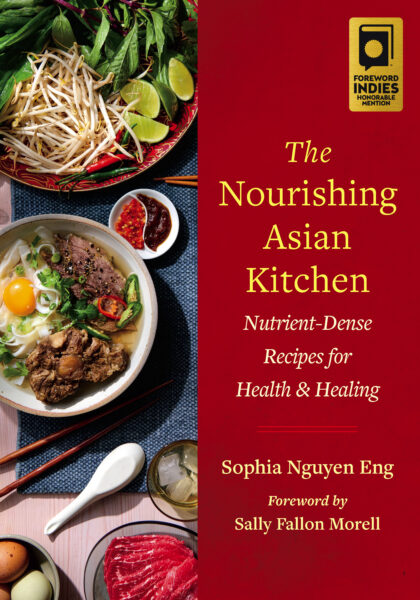

From The Nourishing Asian Kitchen by Sophia Nguyen Eng

Looking for a unique way to cook with turkey this winter? This gluten-free and kosher recipe for turkey egg rolls is sure to impress everyone at the dinner table. Serve these easy-to-make appetizers with a side of Vietnamese dipping sauce for an extra kick of flavor!

How to Make Groundnut Sweet Potato Stew

How to Make Groundnut Sweet Potato Stew

From Wild Fermentation by Sandor Katz

It’s officially stew season! Warm yourself up from the inside out by making groundnut sweet potato stew, a favorite of fermentation revivalist Sandor Katz.

Pears Wrapped in Pastry with Crème Anglaise

Pears Wrapped in Pastry with Crème Anglaise

From The Book of Pears by Joan Morgan

Add a twist to your dessert dishes this winter! These pears wrapped in pastry not only smell and taste amazing, they’re very easy to make and are ‘pear’-fect for serving guests.

Recommended Reads

Recent Articles

Chances are, you’ve seen cattails growing on the edge of your local lake or stream at least once or twice. Instead of just passing these plants, try foraging for and cooking them to create delicious seasonal dishes! The following excerpt is from The New Wildcrafted Cuisine by Pascal Baudar. It has been adapted for the…

Read MoreGarlic mustard: while known as “invasive,” this plant can be consumed in its entirety and has great nutritional value. Plus, the garlic-flavor is a perfect addition to any recipe that calls for mustard! The following are excerpts from Beyond the War on Invasive Species by Tao Orion and The Wild Wisdom of Weeds by Katrina…

Read MoreOh, honeysuckle…how we love thee. If only there was a way to capture the sweet essence of this plant so we could enjoy it more than just in passing. Luckily, foraging and some preparation can help make that happen! Here’s a springtime recipe that tastes exactly like honeysuckle smells. The following excerpt is from Forage,…

Read MoreIntroducing…your new favorite brunch dish! This whole broccoli frittata is packed with fresh, wildcrafted flavors that are bound to help you start your day off on the right foot. The following is an excerpt from The Forager Chef’s Book of Flora by Alan Bergo. It has been adapted for the web. RECIPE: Whole Broccoli Frittata…

Read MoreWondering where to forage for greens this spring? Look no further than hedges, which serve as natural havens for wild greens and herbs! The following is an excerpt from Hedgelands by Christopher Hart. It has been adapted for the web. Food from Hedges: Salads and Greens Let’s start by looking at all the wild foods…

Read More