The Magic of Exploring the Outdoors After Dark: Q&A with Chris Salisbury

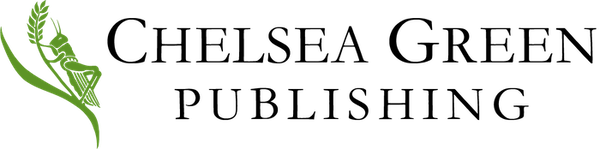

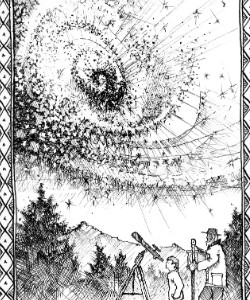

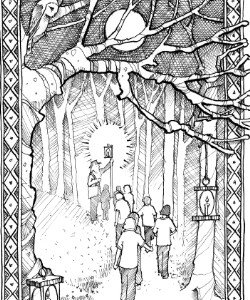

Chris Salisbury’s newest book Wild Nights Out has just been released and encourages us to venture out into the unknown of the night. Wild Nights Out is the go-to guide for exploring the outdoors after dark. It boosts the resilience and self-confidence of children and adults, and instills a lifelong love of having fun in the outdoors after the sun sets.

Chris Salisbury founded WildWise in 1999 after working as an education officer for Devon Wildlife Trust. With a background in the theatre, a training in therapy and a career in environmental education, he uses every creative means at his disposal to encourage people to enjoy and value the natural world.

The following interview first appeared on A Great Read. It has been adapted for the web.

Q: Your website and Instagram are packed with the most incredible photographs! Do you do all the photography on your own?

A: I do most, as I’m facilitating the events I’m ‘on the spot’, so try to record the experiences people are having.

Q:What made you decide to write this book?

A: Its been in my mind for about 12 years – nobody has written about doing things in the dark and I wanted to help outdoor practioners lead experiences in this forgotten realm

Q:What got you interested in wildlife and bushcraft in the first place?

A: I was lucky to live near some woods as a child, so had access to the best sort of playground. Bushcraft came along when one of my volunteers at the Devon Wildlife Trust showed me a brochure that introduced it. It was from Ray Mears’ organisation and we forget that he coined the term and in the 90’s nobody had heard of it as a term. I went down there like a shot and immersed myself on Ray’s courses and have applied it ever since.

Q: Which course do you most love to run, and why?

A: I tend to favour diversity, and so the rather unsatisfactory answer is ‘whichever one I’m running at the time’. There’s no doubt that in my senior phase of life I do love the training of adults who want to learn about facilitating nature connection- this is a sort of ‘golden harvest’ for me and gratifying to see graduates of the year-programmes applying the training to their settings.

A: There’s always something to delight/surprise/mystify. The most memorable will usually be the most recent – for example, last week it was a nightjar that flew up from the ground in the middle of our twilight sit-spot.

Q: Conservation is essential, and young people are keen to learn about how they can help. What would you like to see implemented in schools across the country to help conservation efforts?

A: As someone wisely said, ‘you can only conserve what you love’, and so some fundamental connection to the natural world must form the basis of all outdoor education, and needs to be in place before a child reaches the age of 10. Research shows it’s hard to put that connection in place after that.

Q: How useful do you think bushcraft and outdoor skills would be as part of the general education system?

A: It has everything to offer the education system- there’s a complete syllabus there to galvanise the whole child and develop their capacities more effectively than the current national curriculum.

A study done years ago by Learning through Landscapes concluded that 55% of the NC is better taught outdoors.

Q: What have people discovered on your courses, and what do you hope they discover from the book?

A: Big questions deserve longer answers, but the gist of it is there’s a ‘homecoming’ that takes place for people committing some time with us outdoors. I’ve seen it countless times the way that people relax and come alive – as if they’ve discovered their true habitat.

Q: Do you think night walks are best shared with others, or are they better alone?

A: Different strokes for different folks – there’s treasure to be found in doing it both ways. Likelihood is you’ll notice more if you are alone, and when we escape from the social distractions, we give ourselves a very different experience. Then again, a shared experience can offer something special.

A: Kalahari desert….with a guide!

Q: What’s your view on zoos and safari parks? Do you think native wildlife will ever need to be kept in places like that?

A: There maybe a conservation value in retaining the gene pool, but really we should be talking about rewilding Britain

Q: Who do you think is your typical reader, if such a person exists? Who would you love to read your book?

A: The publishers have made it accessible for a wide audience, but I initially conceived it for outdoor practitioners taking people out into nature at night.

Q: Do you have a favourite genre or author? What books or authors would you say were significant influences on you?

A: Most recently, ‘Rebirding’ by Benedict MacDonald, which is a brilliant account on the subject of rewilding Britain. As a child I read fantasy stories and this fed my imagination which was a good investment to have made

Q: Virtual socialising in lockdown has been invaluable. Now that we’re allowed to meet up in person again, who would be coming on your fantasy night out, and why?

A: I’d love to go for a walk with Ray Mears to rekindle that connection from long ago, and in terms of making new acquaintance, I have a lot of respect for Chris Packham, who did the foreword for my book – I reckon he’d be great company. And, a never-to-be-realised fantasy would be a stroll with Mary Oliver, one of my favourite poets who died recently.

Q: The COVID-19 situation has affected us all in different ways. How have you been managing in the lockdowns?

A: I’ve been writing a book! Gave me the time – at last….!

Q: What would your perfect day look like, and what’s the first place you want to visit after lockdown?

A: I’ve been fortunate to be part of a project that supports the San Bushman in the Kalahari through CyberTracking, and going out tracking with them is pretty perfect

Q: What are you reading at the moment?

A: My friend and colleague Sam Lee’s book ‘The Nightingale’

Q: What was your favourite book as a child?

A: There was a series of books I read as a child by Willard Price that told the stories of two brothers who went round the world capturing wild animals for their father’s zoo, and I lapped them up.

Thank you very much for speaking to us, we wish you every success with the book.

Thank you so much

Recommended Reads

Recent Articles

Ditch ordinary spices and unlock your local flavors with wild seeds! Dill Weed Seasoning is a simple, tasty blend of dried herbs and wild dill weed. It makes a delicious, flavorful, versatile spice mix to season many dishes.

Read MoreThe humble leek! Ever wondered how the humble leek evolved into a modern superfood? Discover its fascinating story now and learn something new today!

Read MoreYou know of Dasher, Dancer, Prancer & Vixen. Comet, Cupid, Donner & Blitzen. Rudolph too! But have you heard of the Sámi people who herd reindeer in Norway?

Read MoreWintergreen is the stunning evergreen groundcover that’s a game-changer for your garden! It’s cherished for its aromatic leaves, vibrant fall color & bright berries.

Read MoreThe fig tree is more than just a fruit-bearing wonder. The complex nature of these trees is beyond fascinating. They are the ultimate ecosystem superheroes!

Read More