How to Get the Most Out of Your Wood-Fired Oven

What could be better than an oven you can build yourself, that allows you to cook an array of delicious foods outside, and can help restore the individual and communal resiliency we’ve lost in recent decades? Follow these tips to learn how to make and maintain your own wood-fired oven!

The following is an excerpt from From the Wood-Fired Oven by Richard Miscovich. It has been adapted for the web.

There is nothing like hearing birds sing in the middle of the night when a masonry over is swept of ash in preparation for baking. The smell of wood smoke is still in my shirt and the oven is equalizing, cooling to the proper baking temp. Heat completely saturates the thermal mass. The oven ticks. The dough proofs. Dawn blurs the edge of the horizon. The first sound of the morning commute comes across the fields. And then it all comes together. The proofed loaves are fluffy and asking to be baked. The oven is ready. Gentle, steady wood-fired heat seems hungry for dough. Steam is injected into the oven; I hold the scoring razor conveniently in my mouth. And then load after load, into the oven endlessly baking. The sun is full now, loaves are high-graded, somebody stops by the ovenhouse to get an early pick. Then the last load, going in with the hope of sufficient heat. It is out. The loaves are loaded for delivery and taken to town. Magdalena sits, resting, waiting for the next bake day…

Back home in North Carolina I baked with new inspiration buttressed by a load of information. But there was something special about our own little baker fueled with pecan and coast oak – not better or worse, but different from the competition breads coming out of deck ovens.

It was a sense of providing food for my community. I was learning the most fundamental aspects of bread baking. Changed in the weather, customer demand, or production schedule often affected the consistency of the loaves. I baked commercially out of Magdalena for three years, until I felt the need to learn more than I could at workshops, trade shows, and through the guild’s newsletter. In the fall of 2000 I left the coast of North Carolina to bake at the King Arthur Flour bakery in Vermont. It was very difficult to leave Magdalena, my all-night companion, but Vermont brought the promise of good things to come. I learned from and baked with Jeffrey Hamelman and other talented bakers at King Arthur. A steady population of students came through the Baking Education Center for professional classes taught by Jeffrey, and I learned from their questions. Some of them became friends and colleagues, and I’ve watched them transition from their old life to the life of a baker or bakery owner. I was especially fortunate to work with visiting instructors like Maggie Glezer, author of Artisan Baking Across America, and James MacGuire, the chef/pastry chef and baker who was my direct link to the teachings of Professor Raymond Calvel, the French bread scientist who developed the autolyse and preached the value of proper dough temperature. I assisted James and then co-taught with him. My formulas for Pain Rustique, 67% Rye, and Miche came from Calvel and James.

It was a sense of providing food for my community. I was learning the most fundamental aspects of bread baking. Changed in the weather, customer demand, or production schedule often affected the consistency of the loaves. I baked commercially out of Magdalena for three years, until I felt the need to learn more than I could at workshops, trade shows, and through the guild’s newsletter. In the fall of 2000 I left the coast of North Carolina to bake at the King Arthur Flour bakery in Vermont. It was very difficult to leave Magdalena, my all-night companion, but Vermont brought the promise of good things to come. I learned from and baked with Jeffrey Hamelman and other talented bakers at King Arthur. A steady population of students came through the Baking Education Center for professional classes taught by Jeffrey, and I learned from their questions. Some of them became friends and colleagues, and I’ve watched them transition from their old life to the life of a baker or bakery owner. I was especially fortunate to work with visiting instructors like Maggie Glezer, author of Artisan Baking Across America, and James MacGuire, the chef/pastry chef and baker who was my direct link to the teachings of Professor Raymond Calvel, the French bread scientist who developed the autolyse and preached the value of proper dough temperature. I assisted James and then co-taught with him. My formulas for Pain Rustique, 67% Rye, and Miche came from Calvel and James.

Vermont offered a concentration of bakers and ovens, and many people I’d read or heard about seemed to live within an easy drive. Most notable was Dan Wing, coauthor of The Bread Builders. I met Dan when he trailered his portable brick oven to King Arthur for a weekend intensive. At the time, portable masonry ovens were a rare precursor to today’s pizza catering and farmer’s market scene. Dan’s class quickly sold out, and I started to hear questions that are still asked today and addressed in this book:

“How long do I fire the over? Why is steam important? How do I get open holes in my bread? What is the best type of oven for me to build?” Interest in wood-fired ovens was growing.

I started teaching baguette and sourdough classes after my shift in the bakery. There I encountered the joys of helping people learn the skills to bake good bread at home with their own two hands. I realized that bread is a social leveler. There is an attraction to bread that transcends age, gender, race, socioeconomic stratum, and any other category you can think of. I was humbled to realize in class one day that I was teaching handmade bread techniques to a woman who had been baking bread longer than I had been alive.

The teaching continued to draw me in, just as bread baking had. So it was hard to turn down the opportunity to make the move to full-time teaching at Johnson & Wales in Providence, Rhode Island. Although we were sorry to leave our sweet cabin in the Vermont woods and our good King Arthur friends, it was a great chance to fain experience in another part of the baking world. Plus, it provided a summer teaching break and the change to go back and bake in Magdalena again!

It was a perfect time to get back into small-scale brick oven baking. I had learned a lot about baking by that time, and the organic, local food scene had gone mainstream. The greater awareness of, and demand for, high-quality local food increased the acreage of organic wheat, and this greater supply allowed millers to draw and blend from more sources and create flours with more consistency. My old customer base remembered my role as village baker, and word got around that once again there was bread on Golden Farm Road. The tourist industry was perfectly in sync with my summer teaching break, and Kyle Swain’s Blue Moon Bistro, my favorite restaurant, was happy to serve my bread alongside his delicious coastal cuisine.

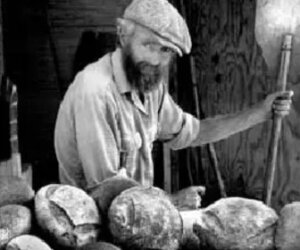

Alan Scott in 1988. Photo by Art Rogers.

The larger wood-oven world continued – and continues – to grow. King Arthur installed a wood-fired oven in the Baking Education Center, and I started regularly guest teaching classes there. I met people who installed similar oven kits, built clay ovens or masonry ovens based on Alan Scott plans. Some students wanted input on what type of oven to build. And still I heard the common questions I’d been aware of since that first class with Dan Wing about firing times, steam, and open crumb. The times Tom Trout gave me when I was building Magdalena began to filter into the amateur wood-fired oven world.

By this time the wood-fired oven scene was populated by many different styles, shapes and designs. Domed brick Pompeii ovens, Clay bread ovens from Quebec. Backyard bread ovens. Commercial production ovens. Scandinavian ovens, necessarily efficient in a land where wood has long been scarce and precious. Colonial beehive ovens unearthed from plaster walls during renovations in old homes across the northeastern United States. But the Alan Scott oven design became the reference point by which other wood-fired ovens are described. Chances are a North America stonemason and oven builder knows the Alan Scott oven. The Bread Builders spawned countless micro-bakeries across the country, because it showed aspiring bakers how to build an economical brick oven that could turn out artisan hearth loaves earmarked with the seal of Old World artisanship.

In addition to Alan’s inspiration – and under the guidance of professional masons – the possibility of building or having a wood-fired oven has become pretty accessible to everyone. You do not have to be a mason to build an Alan Scott oven, and many people came to the endeavor through their journey as bread bakers or piazzalos, very often with no prior masonry experience at all. Like me, for example. I followed Alan’s plans, built this magic thing, and became enchanted by the primal essence of the fire.

Alan’s design and The Bread Builders still inspire and encourage many segments of society: folks living off the grid, affluent foodies, entrepreneurs, budding masons, community builders, bread beads, fifth-generation immigrants reconnecting with their Nonna’s food traditions. All these folks, helped along by input from professional masons and combustion experts through online chatgroups and construction site epiphanies, have led us to this exciting time in wood-fired ovens, fueled by a sense of community focused on fire.

Not only is there excitement for baking and oven construction, but we’re also seeing the resurgence in regional, small-scale grain production and milling. The rise and almost obsessive interest in handmade bread, surge of community farmer’s markets, and availability of local, small-scale artisan food is helping recalibrate our culture and economy. Not to mention a food-truck phenomenon that includes mobil wood-fired pizza ovens! Alan’s vision of communities gathering around wood-fired bread ovens has caught on, but time, and momentum continues to grow nearly 15 years after The Bread Builders was published. Alan took action to see that this centuries-old tradition was kept alive, and he did it well. Look around. Somewhere near you, there is likely someone baking bread in a wood-fired oven and sharing it within the community. Not only is Alan’s vision happening, it’s thriving.

I wrote this book to share my love and interest in cooking and baking bread in the wide spectrum of wood-fired oven temperature environments; to spread the thrill (and responsibility) of efficient combustion; and to brief you on important innovations and refinements in oven design, construction, and materials.

Recommended Reads

Recent Articles

Chances are, you’ve seen cattails growing on the edge of your local lake or stream at least once or twice. Instead of just passing these plants, try foraging for and cooking them to create delicious seasonal dishes! The following excerpt is from The New Wildcrafted Cuisine by Pascal Baudar. It has been adapted for the…

Read MoreGarlic mustard: while known as “invasive,” this plant can be consumed in its entirety and has great nutritional value. Plus, the garlic-flavor is a perfect addition to any recipe that calls for mustard! The following are excerpts from Beyond the War on Invasive Species by Tao Orion and The Wild Wisdom of Weeds by Katrina…

Read MoreOh, honeysuckle…how we love thee. If only there was a way to capture the sweet essence of this plant so we could enjoy it more than just in passing. Luckily, foraging and some preparation can help make that happen! Here’s a springtime recipe that tastes exactly like honeysuckle smells. The following excerpt is from Forage,…

Read MoreIntroducing…your new favorite brunch dish! This whole broccoli frittata is packed with fresh, wildcrafted flavors that are bound to help you start your day off on the right foot. The following is an excerpt from The Forager Chef’s Book of Flora by Alan Bergo. It has been adapted for the web. RECIPE: Whole Broccoli Frittata…

Read MoreWondering where to forage for greens this spring? Look no further than hedges, which serve as natural havens for wild greens and herbs! The following is an excerpt from Hedgelands by Christopher Hart. It has been adapted for the web. Food from Hedges: Salads and Greens Let’s start by looking at all the wild foods…

Read More