The Battle of Seattle and the Power of Going to Jail for Justice

On November 30th, 1999, thousands of protestors descended on the Washington State Convention and Trade Center, where the World Trade Organization (WTO) Ministerial Conference was being held to discuss economic globalization, a controversial set of negotiations.

Several groups of protestors ranging from students to civilians, took control of the city blocks surrounding the building, deterring police forces. Eventually, the governor called a state of emergency due to the number of protestors, marking this as a significant demonstration of public power.

The following is an excerpt from Shut It Down by Lisa Fithian. It has been adapted for the web.

Prefer audio?

Listen to the following excerpt from the audiobook of Shut It Down.

At two in the morning on December 2, 1999, I sat on a bus outside an arrestee processing center in Seattle with a mighty group of fifty rabble-rousers and dissidents. The Battle of Seattle raged in the streets as we waited on the bus, not knowing what the police had in mind for us. We’d been arrested the morning before while demonstrating in a public park, and had been chanting, singing, and sleeping on that bus for fifteen hours.

An officer came aboard and started the engine. Finally! I thought. But when they didn’t pull forward to where the other buses were parked, I was confused. When they drove around to the back of the building, where there were no media or supporters to witness, my confusion became fear.

This was the moment we had prepared for.

We had decided that our strategy was to non-cooperate with the police, which often involves going limp when they come to take you away rather than cooperating by walking along. It can also mean refusing to give your name at the station, forcing them to process you as Jane Doe or John Doe.

As the police entered the bus, we moved off the seats and formed a human chain, sitting down in the aisle, holding on to each other from behind. I was about the tenth person from the door. I sat behind Peter Lumsdaine, a tall, slender, soft-spoken organizer in the anti-nuclear movement. One by one the police came in and, with difficulty, pulled people off the bus.

The officers were frustrated. You could feel the pressure building. Peter was next; he held on to the seat leg. The next thing I knew, the policeman was unloading a canister of pepper spray directly into Peter’s face. He screamed in pain as they pulled him out. It was horrible and terrifying, and I was next.

When they came for me with canister in hand, I made a quick choice. I did not hold on or go limp. I got up and walked off the bus.

This was the beginning of a five-day journey non-cooperating in the Seattle jail. I have always been an advocate of non-cooperation in our acts of civil disobedience, because that is where our true power lies—but sometimes, the cost is greater than the gain. Non-cooperation is safer when you have a community backing you, and in Seattle, we had one hell of a community, along with detailed plans for jail solidarity.

What happened in Seattle changed the world. We came sixty thousand strong to stop the World Trade Organization (WTO) from consolidating its power during their ministerial conference taking place at the Washington Convention and Trade Center in downtown Seattle. The anti-WTO protests represented a new coming-together of previously insular movements—a nascent global justice movement rising up in response to a newly globalized neoliberal world order.

Before Seattle, most people had no clue what the WTO was. After Seattle, it was a household discussion. We pierced the dominant cultural veil, and when the state came down hard against us, we rose up with beauty, courage, and grace. Our fierce ragtag community had the audacity to imagine that a shutdown of the ministerial was possible, and then did the hard work and community building that made it happen.

The whole world was watching as the battle raged for days.

Seattle, for me, was about hope. We came from every movement, every direction, every age, and every race to say no to the WTO. The contemporary global justice movement was taking shape, and in the two decades since Seattle, there have been successes and failures, as there always are. In 1999 the seeds of the movement were blooming with creativity, energy, and action, and the spirit of that time has carried us a long way.

The Global Justice Movement Blooms

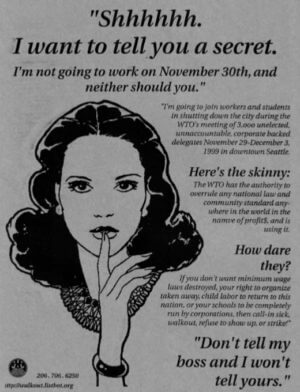

Flyer for the student and labor walkout during the WTO protests in Seattle.

Some say that the anti-WTO convergence in Seattle was the beginning of a movement, but it was not. It was an outgrowth of many movements across the world that were fighting corporate globalization.

The WTO’s roots go back to the 1940s, when forty-four allied nations gathered in Bretton Woods, New Hampshire, for a UN conference on monetary policy. A new system and new institutions were created, including the International Monetary Fund (IMF) and what was to become the World Bank.

In 1948 a collaboration of nations negotiated a global trade deal called the General Agreement on Tariffs and Trade, or GATT. After several more decades and rounds of trade negotiation, the World Trade Organization was formed in 1994, replacing GATT. The WTO took on the role of global negotiator and administrator of multilateral trade agreements, and judge, jury, and arbitrator of global trade disputes.

The capitalists had achieved their global infrastructure, generating enormous wealth for industrialized nations at the expense of the people and the environment. In the US, corporations had been gutting the manufacturing industries and moving work overseas, creating massive job and wage losses. Business education became dominant in colleges as a massive financial services industry grew. CEO and executive pay increased, creating an even deeper wage gap.

The IMF and World Bank were putting country after country in the Global South into debt. Loans with big interest rates were conditioned on the imposition of structural adjustment policies. This meant major cuts to social programs, driving people deeper into poverty while their land, labor, and natural resources were made available on the global market. Sweatshops boomed. Farmers lost their farms. Indigenous people lost their forests, land, and water. Global pain was spreading, and we were told there was no alternative.

But was this path inevitable? We didn’t think so. And we did not stay home.

Recommended Reads

Recent Articles

Want to witness the magic of the mini-forest? When you practice The Miyawaki Method, a unique approach to reforestation, you’ll see an empty lot or backyard transform into a biodiverse forest before your very eyes. The following is an excerpt from Mini-Forest Revolution by Hannah Lewis. It has been adapted for the web. Photo Credit:…

Read MoreWhen you plan out how you want your garden to look and operate, you’re setting yourself up for long-term success. Here are some helpful tips on how to plan the best garden this upcoming growing season! The following excerpt is from The Resilient Gardener: Food Production and Self-Reliance in Uncertain Times by Carol Deppe. It has been…

Read MoreAddressing the pressing issues affecting everyday Americans is essential—and one of our nation’s most profound challenges is the devastating impact of mass layoffs. Layoffs upend people’s lives, cause enormous stress, and lead to debilitating personal debt. The societal harm caused by mass layoffs has been known for decades. Yet, we do little to stop them.…

Read MoreThis fig pecan bread is a sweet, delicious, and nutritious side that everyone around the table will enjoy this winter (or maybe you’ll want to keep it all to yourself, we won’t judge). Enjoy! The following is an excerpt from From the Wood-Fired Oven by Richard Miscovich. It has been adapted for the web. What…

Read MoreWhat if we told you that there was a way to extend your growing season and save time & money? The answer is all in arugula. With quick hoops and greenhouse film, you’ll be on your way to harvesting sweet & flavorful arugula in no time. The following excerpt is from The Resilient Farm and…

Read More