Change Ourselves, Change the World

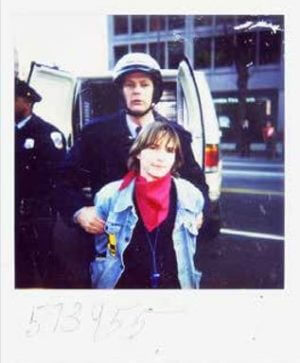

Lisa Fithian has shut down the CIA. She has disrupted the World Trade Organization and camped in a ditch with Gold Star mom and protester of the Iraq War, Cindy Sheehan. She has stood her ground in Tahrir Square, occupied Wall Street, marched in the streets of Ferguson, and walked in solidarity with tribal leaders at Standing Rock. Now in her fifth decade of anti-racist organizing, Fithian doesn’t intend to stop fighting. Her book, Shut it Down: Stories from a Fierce, Loving Resistance, gets at the roots of her powerful, unstoppable activism, and why each person’s unalienable right to resist fiercely and, yes, lovingly is more important now than ever before.

The following is an interview with Lisa Fithian from the Winter 2019 Seasonal Journal. It has been adapted for the web.

This book helps focus what I believe is at the core of each successful uprising: how to build crisis in a way that’s humane and loving. It’s about courage despite fear, and love for one another in the face of hate. Fear is our greatest de-mobilizer. It makes us more vulnerable to negative forces. But when we come from a place of love, we are grounded, connected, and open. Many are living in denial as the world comes down around us. We are reacting, feeling overwhelmed and powerless, instead of acting with creativity, power, and love. The question is how do we go on the offense?

Explain your ideas behind instigating “crisis and chaos” to build a movement. What can anyone gain from what sounds like things we try to avoid?

In living systems there is fundamental chaos. We need it. It’s the space where new things can emerge. When shit gets bad, we realize things need to change. We either resist or close down. To face the chaos to come, inoculation is key—creating an environment suitable for growth. You need to prepare people for what to expect so they don’t back down. It helps them understand their options, and their anger and grief. If we’re in denial about those feelings, they show up in unhelpful ways. Positive feedback fosters more change, while negative feedback reinforces the status quo. In organizing, I embrace the positive whenever possible.

Our limbic system is hardwired to see the danger, the threat. The government knows this and creates all kinds of rational and irrational fears to keep us demobilized, vulnerable. But are we really unsafe? Is this a true threat? Our agency is our power, so we must learn to distinguish between being uncomfortable and being unsafe. This is especially true for white people, who often confuse discomfort with a threat. It’s good practice to ask ourselves, “Is this fear real or a triggered socialized response?” This is where good strategic organizing comes in. We can anticipate, prepare, and create conditions that keep us in our power no matter what the government does.

What kinds of networks and alliances are the most effective for creating change?

What we need are authentic relationships, whomever they’re with. I think shared power networks are the most effective way to build movements, and alliances can be a part of that. Cultural transformation is required to move us away from power-driven ways of relating and toward authentic ways of relating. Alliances aside, we have to be real with one another. We can’t hide. We can’t live in that ego state of trying to be something we’re not. We have to be rooted in solidarity and mutual aid. I’m not here to save you. I’m here to be in solidarity with you. Our liberation is bound up together.

This journey we’re on is each and every one of us doing our own healing. Yet we’re interdependent. We can’t do it alone. Movement work is the same. It’s a lifelong process that we keep showing up for. We’re a big extended family on a long road. And our paths keep crossing. A key piece of Indigenous wisdom asks us to be in right relationship, and many of our current movement structures are not. This is where change needs to happen.

How can we avoid resistance fatigue? How do you sustain your personal motivation and enthusiasm in the face of what can feel like impenetrable forces of power?

I’m really clear on what I believe. When I train, one of my goals is to ignite people’s belief in what’s possible. Once you feel your own power in a beloved community, there’s no going back. We have to be intentional about building cultures that keep us human and help us care for one another…cultures of belonging that accept us for who we are. We don’t learn from feeling guilty or being shamed; this stifles growth and distances us. When I take action, I make sure it is welcoming, colorful, beautiful, uplifting because that’s part of the magic. If we’re not having fun doing this, we’re missing an essential part of change. Joy. Inspiration. Love. When you work from the positive, you create the possibility for something more powerful to emerge.

You are a white, anti-racist organizer. How do you “own your privilege” and use it for good.

Be honest and real. Recognize your privilege and use it strategically. Don’t go in assuming you know about other people’s lived experience. Listen more than talk. Educate yourself. Keep showing up. As white people, we have a choice whether or not to not deal with our white supremacy, but if we don’t, we continue to be sick at some level. I am learning to see myself as an accomplice, not an ally. I, too, have skin in this game. The quality of my life is directly connected to the quality of everyone’s life I come into contact with. Don’t assume that what you can do is needed, savior style. We want to be of use, to change what is wrong, right now.

Be honest and real. Recognize your privilege and use it strategically. Don’t go in assuming you know about other people’s lived experience. Listen more than talk. Educate yourself. Keep showing up. As white people, we have a choice whether or not to not deal with our white supremacy, but if we don’t, we continue to be sick at some level. I am learning to see myself as an accomplice, not an ally. I, too, have skin in this game. The quality of my life is directly connected to the quality of everyone’s life I come into contact with. Don’t assume that what you can do is needed, savior style. We want to be of use, to change what is wrong, right now.

People of color have a different perspective and experience. They’ve been abused and exploited for a long time and have a lot of healing to do. Things won’t change overnight. White people must understand this is life work, that we have the power, access, and resources to make the injustice visible and undo our part in it. This involves learning to give stuff away—money, time, resources, information, access. It’s a choice of no longer being complicit with white supremacy and capitalism. It’s shedding all the trappings of our ego. And it’s liberating to give it away! The measure of the quality of your life is not in what you have but in what you do and give to others.

How has your civil disobedience changed who you are?

It’s given me the confidence to act with courage despite my fears. It has taught me to believe in myself, in people, and that together we can change things. It has given me a sense of wealth even though I have no money. It has helped me to understand my privilege. It has taught me that as we change ourselves, we change the world.

Recommended Reads

Recent Articles

Want to witness the magic of the mini-forest? When you practice The Miyawaki Method, a unique approach to reforestation, you’ll see an empty lot or backyard transform into a biodiverse forest before your very eyes. The following is an excerpt from Mini-Forest Revolution by Hannah Lewis. It has been adapted for the web. Photo Credit:…

Read MoreWhen you plan out how you want your garden to look and operate, you’re setting yourself up for long-term success. Here are some helpful tips on how to plan the best garden this upcoming growing season! The following excerpt is from The Resilient Gardener: Food Production and Self-Reliance in Uncertain Times by Carol Deppe. It has been…

Read MoreAddressing the pressing issues affecting everyday Americans is essential—and one of our nation’s most profound challenges is the devastating impact of mass layoffs. Layoffs upend people’s lives, cause enormous stress, and lead to debilitating personal debt. The societal harm caused by mass layoffs has been known for decades. Yet, we do little to stop them.…

Read MoreThis fig pecan bread is a sweet, delicious, and nutritious side that everyone around the table will enjoy this winter (or maybe you’ll want to keep it all to yourself, we won’t judge). Enjoy! The following is an excerpt from From the Wood-Fired Oven by Richard Miscovich. It has been adapted for the web. What…

Read MoreWhat if we told you that there was a way to extend your growing season and save time & money? The answer is all in arugula. With quick hoops and greenhouse film, you’ll be on your way to harvesting sweet & flavorful arugula in no time. The following excerpt is from The Resilient Farm and…

Read More