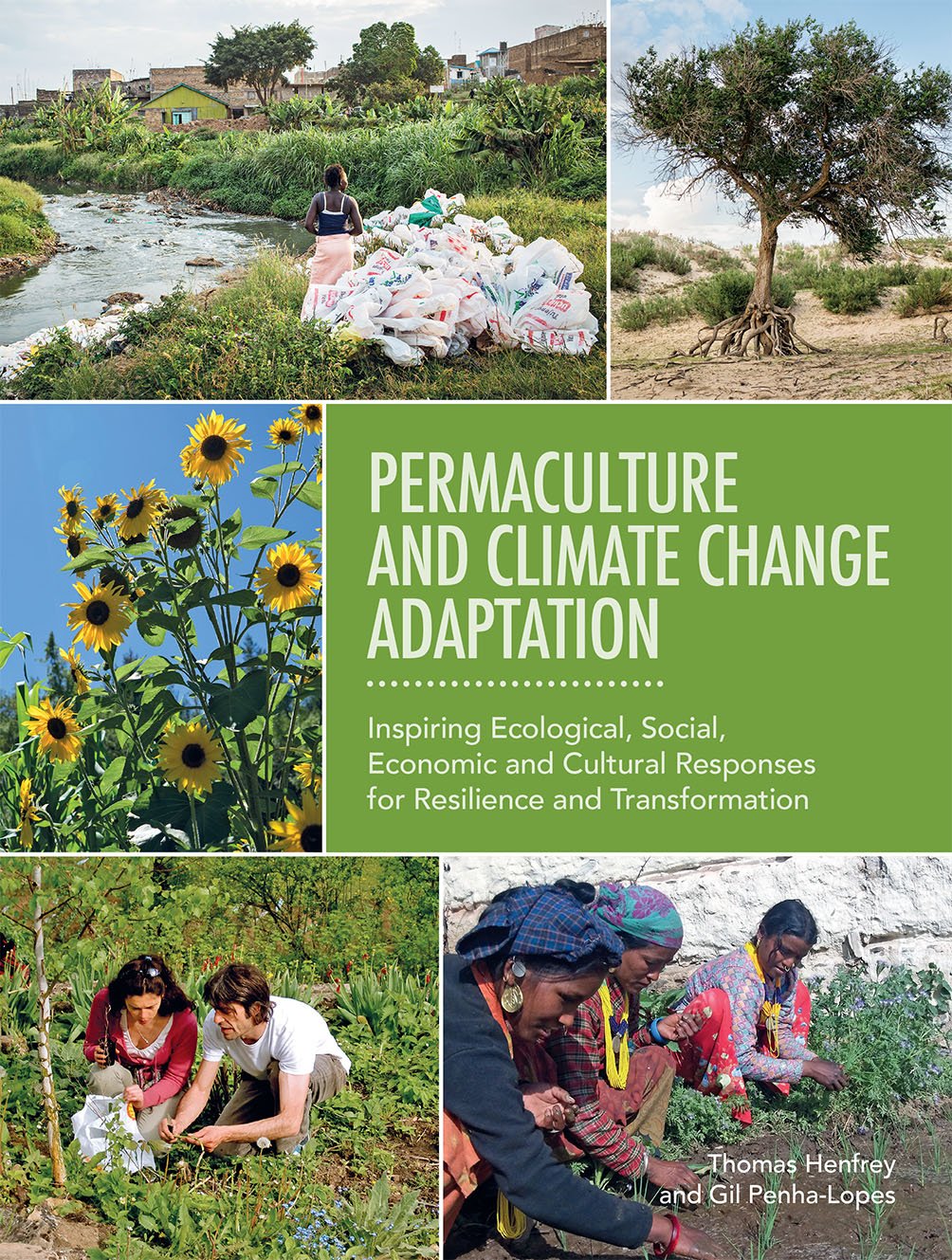

Permaculture and Climate Change Adaptation

Inspiring Ecological, Social, Economic and Cultural Responses for Resilience and Transformation

Permaculture and Climate Change Adaptation

Inspiring Ecological, Social, Economic and Cultural Responses for Resilience and Transformation

Paperback

$11.99

Permaculture is a design system for sustainable human habitats and the basis of a worldwide citizen-led movement present in over 100 countries. For decades, permaculture practitioners have devised creative responses to changes in local climatic conditions. In doing so, they have developed a collective knowledge and experience invaluable to global efforts to address climate change.

This book seeks to bring this expertise from the margins into the centre of policy debates and mainstream action. It describes in broad terms how permaculture’s underlying philosophy and perspective on climate change complements those of formal science and indigenous knowledge, provides detailed descriptions of practical applications drawing on case studies from around the world, and considers how global responses can most effectively draw upon the unique contributions permaculture has to make.