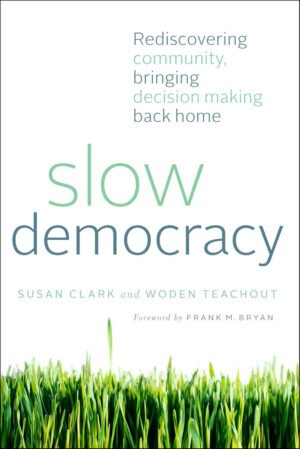

Slow Democracy

Rediscovering Community, Bringing Decision Making Back Home

EXCERPTS

| Pages: | 280 pages |

| Size: | 6 x 9 inch |

| Publisher: | Chelsea Green Publishing |

| Pub. Date: | October 10, 2012 |

| ISBN: | 9781603584135 |

Slow Democracy

Rediscovering Community, Bringing Decision Making Back Home

Paperback

$24.95

Reconnecting with the sources of decisions that affect us, and with the processes of democracy itself, is at the heart of 21st-century sustainable communities.

Slow Democracy chronicles the ways in which ordinary people have mobilized to find local solutions to local problems. It invites us to bring the advantages of “slow” to our community decision making. Just as slow food encourages chefs and eaters to become more intimately involved with the production of local food, slow democracy encourages us to govern ourselves locally with processes that are inclusive, deliberative, and citizen powered.

Susan Clark and Woden Teachout outline the qualities of real, local decision making and show us the range of ways that communities are breathing new life into participatory democracy around the country. We meet residents who seize back control of their municipal water systems from global corporations, parents who find unique solutions to seemingly divisive school-redistricting issues, and a host of other citizens across the nation who have designed local decision-making systems to solve the problems unique to their area in ways that work best for their communities.

Though rooted in the direct participation that defined our nation’s early days, slow democracy is not a romantic vision for reigniting the ways of old. Rather, the strategies outlined here are uniquely suited to 21st-century technologies and culture.If our future holds an increased focus on local food, local energy, and local economy, then surely we will need to improve our skills at local governance as well.

Awards

- Atlas Awards, 2012 Accomplishments

Reviews and Praise

ForeWord Reviews-

In the nineteenth century, robust public participation and civic action was part of the American character. By contrast, we currently comprise a “discouraged, democratically anemic citizenry,” feeling disempowered and voiceless when it comes to influencing the outcome of public policy issues that affect us, our cities, towns, and neighborhoods. Nevertheless, there is a way out of this morass—it’s called ‘slow democracy.’ Taking its cue from the slow food movement (a global, grassroots effort that links a way of living and a way of eating with a commitment to community and sustainability), slow democracy encourages democratic decision-making at the local level by members of the community. It forgoes the ideological divisions of left vs. right and promotes self-governance through processes that are inclusive, deliberative, and citizen-powered. While the notion of wresting power and decision making from the federal level and returning it to citizens and local governments may seem like pie-in-the-sky optimism, activist [Susan] Clark and historian [Woden] Teachout cite numerous places where slow democracy is producing results. In New York City; Chicago; Gloucester, Massachusetts; New Orleans; Portsmouth, New Hampshire; and Hacker Valley, West Virginia “painful issues” like racism and crime and ‘too-hot-to-handle concerns’ like budget cuts, school redistricting, environmental protection, and housing are being addressed by ordinary people committed to citizen engagement and collaborative problem-solving. Slow Democracy is a user-friendly ‘blueprint for American redemption.’ It inspires the belief that our dwindling democracy can be invigorated. City councilors, town managers, community organizers, politicians, and average Americans will find wisdom in Slow Democracy and will learn strategies to bolster public participation and thus transform our political landscape.

More Reviews and Praise

Library Journal-

Clark (All Those in Favor) and Teachout (Union Inst. & Univ.; Capture the Flag) make a strong case for ‘slow democracy’—the inclusive, deliberative, locally based way to reinvigorate American politics. Based on the slow food movement’s principles of localism, community involvement, and sustainability, slow democracy taps the energy, concerns, and common sense of local citizens to improve local decisions. Clark and Teachout explain slow democracy in action, discuss reframing debates to avoid the polarization that passes for politics in the United States, and suggest ways for people to adapt the principles of slow democracy for use in their own political lives. The authors admit that slow democracy takes time—time to gather community members, time for all to tell their stories, and time for citizen groups to find practical and affordable solutions to local problems. VERDICT: This is a convincing argument that time invested in this way benefits everyone in the community and reconnects citizens with their governments and each other. Recommended for anyone interested in being more politically engaged.

Publisher's Weekly-

Making the case for local control and community action while offering plenty of worthwhile advice, community leader Clark and democracy scholar Teachout tell how to get things done in the public sphere. The authors are open about their leftist leanings but make it clear that "slow democracy" is not about partisanship or political labels. On issues including community control of water systems and school re-districting, the authors paint an upbeat picture of participatory democracy. They devote much of the book to success stories, mainly from small cities like Portsmouth, N.H. Intending to be inspirational, sometimes lyrical and crunchy-granola in spirit, Clark and Teachout can resort to the obvious or mundane: "[s]low democracy is about inviting neighbors into community conversations about issues that matter." But readers who instinctively resist suffocating regulations and Big Brother authorities will welcome the book's insights. Clark and Teachout favor a New England-style town-hall political culture that wouldn't last five minutes in Chicago or Los Angeles, yet anyone who wants to reinvigorate grass-roots involvement and moderate top-down rule can benefit from this earnest volume. Activists and organizers will appreciate the useful tips, and Clark and Teachout's community strategies will resonate with both conservatives and progressives.

Kirkus Reviews-

How community deliberative processes can provide an alternative to divisive party politics and technocratic expertise. Community organizer Clark (co-author: All Those in Favor: Rediscovering the Secrets of Town Meeting and Community, 2005) and historian Teachout (Graduate Studies/Union Institute and Univ.; Capture the Flag: A Political History of American Patriotism, 2009, etc.) believe that genuine deliberations by citizens have too often been replaced by top-down political decision-making, in much the same way fast food has been substituted for the genuine article. The authors present case studies in which citizens have come together to solve problems faced by their communities. They cite the city of Portsmouth, N.H., which has won international awards for the way citizens acted together to solve problems confronting their school system when the experts failed. They chronicle citizen transformation of social services, such as Chicago's Police Department, and citizen interventions to take control of municipal or county water supplies. The authors highlight the way Pennsylvanians have organized against fracking through town and county institutions. Each of these cases, they note, was precipitated by a particular set of circumstances that needed to be addressed in a timely way. Clark and Teachout complement their case studies with discussions of useful methodologies to bring people together for common purposes and with a brief history of the New England town meeting format. The major problem local communities face, they write, is outside “efficiency experts” armed with charts and graphs and prepackaged solutions. The authors offer the history of the Appalachian Trail, which runs from Maine to Georgia, as a dramatic example of how “slow politics” works over an extended period of time to build something of lasting value. A valuable tool for improving the way government operates at the local level.

"Slow democracy is the only kind that can take root, because it answers our deepest longings for connection, community, and voice. Clark and Teachout provide compelling examples and guiding principles for nurturing inclusive, participatory communities that work for everyone. Read this book, and then put it into action!"--Martha McCoy, executive director, Everyday Democracy

"The time is exactly right for a book that takes democracy seriously, and knows where to look for it. Clark and Teachout recognize that representative democracy must be rooted in the fertile soil of face-to-face, local, problem-solving democracy. With engaging storytelling skills, they remind us of how vibrant these civic roots still are, and they encourage us to give this democratic garden even greater care and attention, and to enjoy its fruits while we’re at it."--Daniel Kemmis, former mayor of Missoula, Montana; author of Community and the Politics of Place

"Slow Democracy is a lively and significant book. Clark and Teachout use a broad array of stories to illustrate how our democracy is changing, and how we can capitalize on the pressures and opportunities we face in our communities. They describe how carefully structured public engagement can lead, ironically, to faster, better solutions to public problems. Finally, they show how improving local democracy, one place at a time, can add up quickly to much larger national and global impacts."--Matt Leighninger, executive director, Deliberative Democracy Consortium

"It is all too easy to be cynical about the contemporary democratic process. Clark and Teachout provide a roadmap for turning that cynicism into the sort of regionalized action that can improve lives and transform communities. Don't give up on democracy: Read this book and get to work!"--Ben Hewitt, author of The Town that Food Saved and Making Supper Safe

"The "slow" in Slow Democracy doesn't mean decision-making needs to take longer. It's an acknowledgement that investing in inclusive, deliberative, and empowered local decision-making is worth the time. Here are community stories that will fill you with hope for American politics."--Sandy Heierbacher, director, National Coalition for Dialogue & Deliberation

"Great stories about democracy-showing us that democracy is not what we have but what we do. So if you've been 'looking for hope in all the wrong places,' now you've found one that's right! Enjoy."--Frances Moore Lappé, author of EcoMind: Changing the Way We Think to Create the World We Want

"This is a truly important book: it explains, with copious example and lots of common sense, why democracy works better close to home. If you've begun to think the carrot from the farmer's market tastes better, this volume will lead you (liberal or conservative) down the logical path towards a working society."--Bill McKibben, author of Deep Economy: The Wealth of Communities and the Durable Future

"Slow Democracy just may be the best thing happening in America today. Connecting in a meaningful way with our community and reclaiming our power as citizens is both powerful and possible. Read this book and consider how this movement can revitalize the communities you care about!"--Joan Blades, cofounder, MoveOn.org

Reviews and Praise

ForeWord Reviews-

In the nineteenth century, robust public participation and civic action was part of the American character. By contrast, we currently comprise a “discouraged, democratically anemic citizenry,” feeling disempowered and voiceless when it comes to influencing the outcome of public policy issues that affect us, our cities, towns, and neighborhoods. Nevertheless, there is a way out of this morass—it’s called ‘slow democracy.’ Taking its cue from the slow food movement (a global, grassroots effort that links a way of living and a way of eating with a commitment to community and sustainability), slow democracy encourages democratic decision-making at the local level by members of the community. It forgoes the ideological divisions of left vs. right and promotes self-governance through processes that are inclusive, deliberative, and citizen-powered. While the notion of wresting power and decision making from the federal level and returning it to citizens and local governments may seem like pie-in-the-sky optimism, activist [Susan] Clark and historian [Woden] Teachout cite numerous places where slow democracy is producing results. In New York City; Chicago; Gloucester, Massachusetts; New Orleans; Portsmouth, New Hampshire; and Hacker Valley, West Virginia “painful issues” like racism and crime and ‘too-hot-to-handle concerns’ like budget cuts, school redistricting, environmental protection, and housing are being addressed by ordinary people committed to citizen engagement and collaborative problem-solving. Slow Democracy is a user-friendly ‘blueprint for American redemption.’ It inspires the belief that our dwindling democracy can be invigorated. City councilors, town managers, community organizers, politicians, and average Americans will find wisdom in Slow Democracy and will learn strategies to bolster public participation and thus transform our political landscape.

Library Journal-

Clark (All Those in Favor) and Teachout (Union Inst. & Univ.; Capture the Flag) make a strong case for ‘slow democracy’—the inclusive, deliberative, locally based way to reinvigorate American politics. Based on the slow food movement’s principles of localism, community involvement, and sustainability, slow democracy taps the energy, concerns, and common sense of local citizens to improve local decisions. Clark and Teachout explain slow democracy in action, discuss reframing debates to avoid the polarization that passes for politics in the United States, and suggest ways for people to adapt the principles of slow democracy for use in their own political lives. The authors admit that slow democracy takes time—time to gather community members, time for all to tell their stories, and time for citizen groups to find practical and affordable solutions to local problems. VERDICT: This is a convincing argument that time invested in this way benefits everyone in the community and reconnects citizens with their governments and each other. Recommended for anyone interested in being more politically engaged.

Publisher's Weekly-

Making the case for local control and community action while offering plenty of worthwhile advice, community leader Clark and democracy scholar Teachout tell how to get things done in the public sphere. The authors are open about their leftist leanings but make it clear that "slow democracy" is not about partisanship or political labels. On issues including community control of water systems and school re-districting, the authors paint an upbeat picture of participatory democracy. They devote much of the book to success stories, mainly from small cities like Portsmouth, N.H. Intending to be inspirational, sometimes lyrical and crunchy-granola in spirit, Clark and Teachout can resort to the obvious or mundane: "[s]low democracy is about inviting neighbors into community conversations about issues that matter." But readers who instinctively resist suffocating regulations and Big Brother authorities will welcome the book's insights. Clark and Teachout favor a New England-style town-hall political culture that wouldn't last five minutes in Chicago or Los Angeles, yet anyone who wants to reinvigorate grass-roots involvement and moderate top-down rule can benefit from this earnest volume. Activists and organizers will appreciate the useful tips, and Clark and Teachout's community strategies will resonate with both conservatives and progressives.

Kirkus Reviews-

How community deliberative processes can provide an alternative to divisive party politics and technocratic expertise. Community organizer Clark (co-author: All Those in Favor: Rediscovering the Secrets of Town Meeting and Community, 2005) and historian Teachout (Graduate Studies/Union Institute and Univ.; Capture the Flag: A Political History of American Patriotism, 2009, etc.) believe that genuine deliberations by citizens have too often been replaced by top-down political decision-making, in much the same way fast food has been substituted for the genuine article. The authors present case studies in which citizens have come together to solve problems faced by their communities. They cite the city of Portsmouth, N.H., which has won international awards for the way citizens acted together to solve problems confronting their school system when the experts failed. They chronicle citizen transformation of social services, such as Chicago's Police Department, and citizen interventions to take control of municipal or county water supplies. The authors highlight the way Pennsylvanians have organized against fracking through town and county institutions. Each of these cases, they note, was precipitated by a particular set of circumstances that needed to be addressed in a timely way. Clark and Teachout complement their case studies with discussions of useful methodologies to bring people together for common purposes and with a brief history of the New England town meeting format. The major problem local communities face, they write, is outside “efficiency experts” armed with charts and graphs and prepackaged solutions. The authors offer the history of the Appalachian Trail, which runs from Maine to Georgia, as a dramatic example of how “slow politics” works over an extended period of time to build something of lasting value. A valuable tool for improving the way government operates at the local level.

"Slow democracy is the only kind that can take root, because it answers our deepest longings for connection, community, and voice. Clark and Teachout provide compelling examples and guiding principles for nurturing inclusive, participatory communities that work for everyone. Read this book, and then put it into action!"--Martha McCoy, executive director, Everyday Democracy

"The time is exactly right for a book that takes democracy seriously, and knows where to look for it. Clark and Teachout recognize that representative democracy must be rooted in the fertile soil of face-to-face, local, problem-solving democracy. With engaging storytelling skills, they remind us of how vibrant these civic roots still are, and they encourage us to give this democratic garden even greater care and attention, and to enjoy its fruits while we’re at it."--Daniel Kemmis, former mayor of Missoula, Montana; author of Community and the Politics of Place

"Slow Democracy is a lively and significant book. Clark and Teachout use a broad array of stories to illustrate how our democracy is changing, and how we can capitalize on the pressures and opportunities we face in our communities. They describe how carefully structured public engagement can lead, ironically, to faster, better solutions to public problems. Finally, they show how improving local democracy, one place at a time, can add up quickly to much larger national and global impacts."--Matt Leighninger, executive director, Deliberative Democracy Consortium

"It is all too easy to be cynical about the contemporary democratic process. Clark and Teachout provide a roadmap for turning that cynicism into the sort of regionalized action that can improve lives and transform communities. Don't give up on democracy: Read this book and get to work!"--Ben Hewitt, author of The Town that Food Saved and Making Supper Safe

"The "slow" in Slow Democracy doesn't mean decision-making needs to take longer. It's an acknowledgement that investing in inclusive, deliberative, and empowered local decision-making is worth the time. Here are community stories that will fill you with hope for American politics."--Sandy Heierbacher, director, National Coalition for Dialogue & Deliberation

"Great stories about democracy-showing us that democracy is not what we have but what we do. So if you've been 'looking for hope in all the wrong places,' now you've found one that's right! Enjoy."--Frances Moore Lappé, author of EcoMind: Changing the Way We Think to Create the World We Want

"This is a truly important book: it explains, with copious example and lots of common sense, why democracy works better close to home. If you've begun to think the carrot from the farmer's market tastes better, this volume will lead you (liberal or conservative) down the logical path towards a working society."--Bill McKibben, author of Deep Economy: The Wealth of Communities and the Durable Future

"Slow Democracy just may be the best thing happening in America today. Connecting in a meaningful way with our community and reclaiming our power as citizens is both powerful and possible. Read this book and consider how this movement can revitalize the communities you care about!"--Joan Blades, cofounder, MoveOn.org