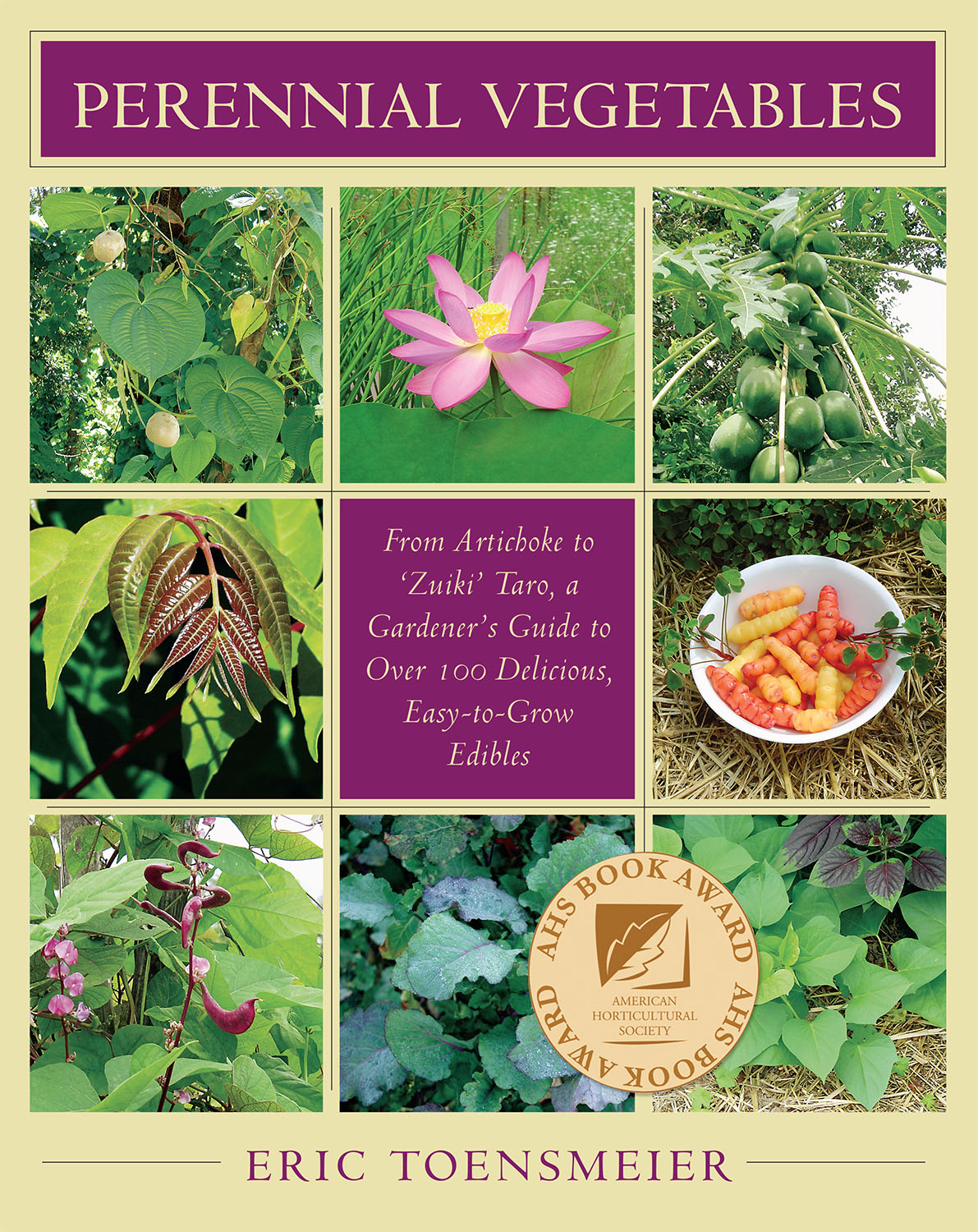

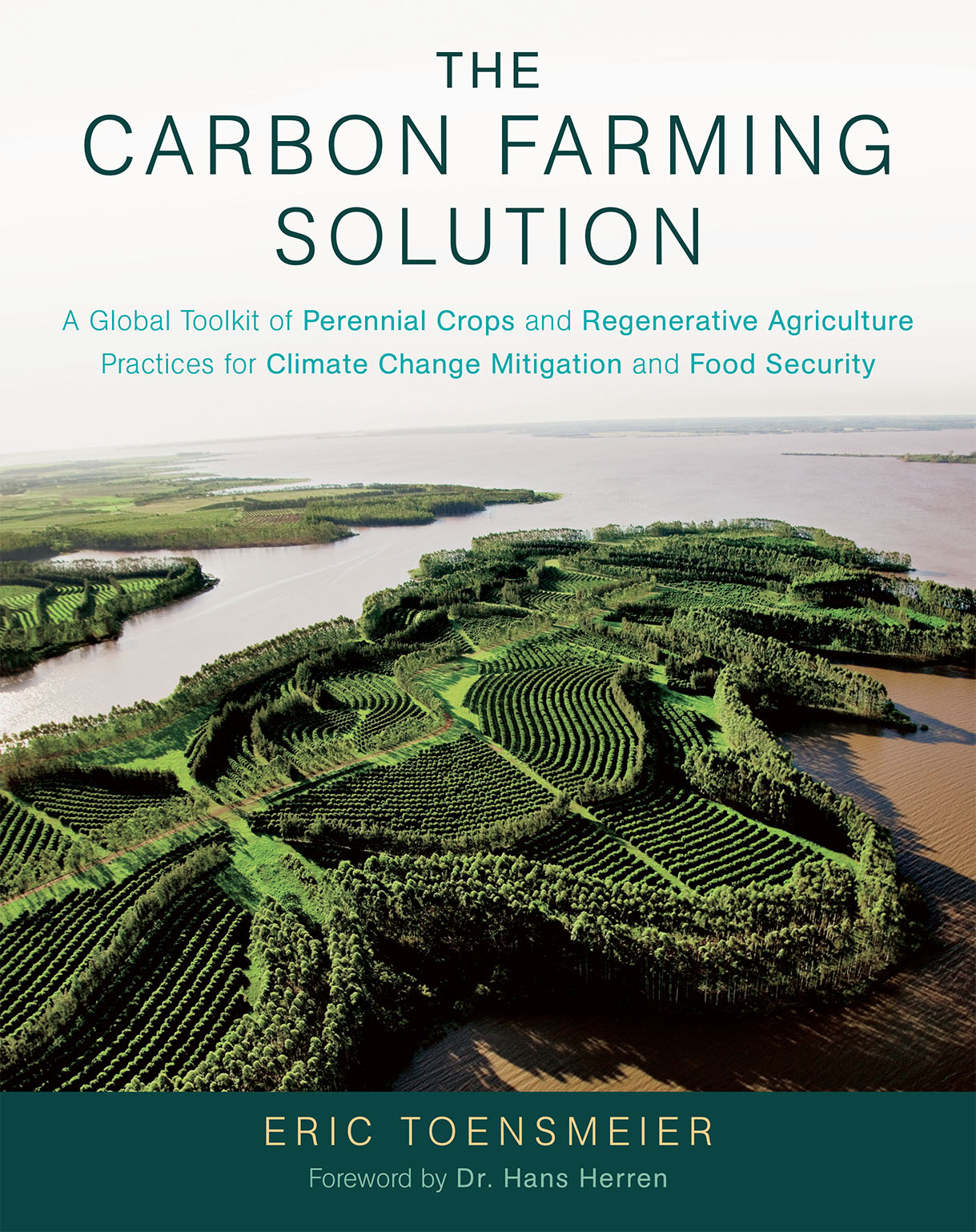

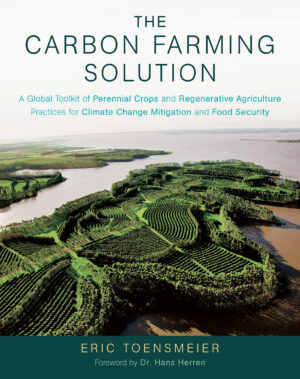

The Carbon Farming Solution

A Global Toolkit of Perennial Crops and Regenerative Agriculture Practices for Climate Change Mitigation and Food Security

EXCERPTS

| Pages: | 512 pages |

| Book Art: | Color photos, tables, charts, and illustrations |

| Size: | 8.5 x 10.5 inch |

| Publisher: | Chelsea Green Publishing |

| Pub. Date: | February 22, 2016 |

| ISBN: | 9781603585712 |

The Carbon Farming Solution

A Global Toolkit of Perennial Crops and Regenerative Agriculture Practices for Climate Change Mitigation and Food Security

With carbon farming, agriculture ceases to be part of the climate problem and becomes a critical part of the solution

“This book is the toolkit for making the soil itself a sponge for carbon. It’s a powerful vision.”—Bill McKibben

“The Carbon Farming Solution is a book we will look back upon decades from now and wonder why something so critically relevant could have been so overlooked until that time. . . . [It] describes the foundation of the future of civilization.”—Paul Hawken

In this groundbreaking book, Eric Toensmeier argues that agriculture—specifically, the subset of practices known as “carbon farming”—can, and should be, a linchpin of a global climate solutions platform.

Carbon farming is a suite of agricultural practices and crops that sequester carbon in the soil and in above-ground biomass. Combined with a massive reduction in fossil fuel emissions—and in concert with adaptation strategies to our changing environment— carbon farming has the potential to bring us back from the brink of disaster and return our atmosphere to the “magic number” of 350 parts per million of carbon dioxide. Toensmeier’s book is the first to bring together these powerful strategies in one place.

Includes in-depth analysis of the available research.

Carbon farming can take many forms. The simplest practices involve modifications to annual crop production. Although many of these modifications have relatively low sequestration potential, they are widely applicable and easily adopted, and thus have excellent potential to mitigate climate change if practiced on a global scale. Likewise, grazing systems such as silvopasture are easily replicable, don’t require significant changes to human diet, and—given the amount of agricultural land worldwide that is devoted to pasture—can be important strategies in the carbon farming arsenal. But by far, agroforestry practices and perennial crops present the best opportunities for sequestration. While many of these systems are challenging to establish and manage, and would require us to change our diets to new and largely unfamiliar perennial crops, they also offer huge potential that has been almost entirely ignored by climate crusaders.

Many of these carbon farming practices are already implemented globally on a scale of millions of hectares. These are not minor or marginal efforts, but win-win solutions that provide food, fodder, and feedstocks while fostering community self-reliance, creating jobs, protecting biodiversity, and repairing degraded land—all while sequestering carbon, reducing emissions, and ultimately contributing to a climate that will remain amenable to human civilization. Just as importantly to a livable future, these crops and practices can contribute to broader social goals such as women’s empowerment, food sovereignty, and climate justice.

The Carbon Farming Solution is—at its root—a toolkit and the most complete collection of climate-friendly crops and practices currently available.

With this toolkit, farmers, communities, and governments large and small, can successfully launch carbon farming projects with the most appropriate crops and practices to their climate, locale, and socioeconomic needs.

Toensmeier’s ultimate goal is to place carbon farming firmly in the center of the climate solutions platform, alongside clean solar and wind energy. With The Carbon Farming Solution, Toensmeier wants to change the discussion, impact policy decisions, and steer mitigation funds to the research, projects, and people around the world who envision a future where agriculture becomes the protagonist in this fraught, urgent, and unprecedented drama of our time. Citizens, farmers, and funders will be inspired to use the tools presented in this important book to transform degraded lands around the world into productive carbon-storing landscapes.

Reviews and Praise

Journal of Agroecology and Sustainable Food Systems-

"Readers interested in carbon capture and climate mitigation will welcome this new resource, one of the most complete books on the market today that deals with what could be called 'carbon farming.' Although the focus is on perennial crops and systems often grouped under the topics of agroforestry, or more recently permaculture, the book also delves into creative and biodiverse annual cropping and livestock systems, new crops, and innovative designs all focused on the issue of carbon. Toensmeier is an applied ecologist with extensive experience in the Latin American tropics, and practices these principles in workshops, books, and at home. More than a reference volume, The Carbon Farming Solution is an easily read and interesting overview of this important frontier. … The appendixes to the book provide a wealth of data on species and relevant references that could keep anyone truly interested engaged for months in following up on sources and designing new systems based on these ideas. The Carbon Farming Solution is indeed a monumental project that will help guide tropical agricultural development for decades, and Toensmeier has provided a significant resource for those concerned about climate and the future.”

More Reviews and Praise

Choice-

"The terrestrial carbon pool is one of the most dynamic because it is directly affected by how people manage soils and implement cropping systems. The renewed interest in sequestering carbon into the soil reservoir creates a series of questions on how to introduce practices that are effective in increasing soil carbon along with providing plant resources to sustain the goods and services needed for a healthy ecosystem. In this volume, Toensmeier (Yale Univ.), co-author with David Jacke of Edible Forest Gardens, (v. 1) (CH, Jan'06, 43-2794), explores the carbon sequestration potential of different agroecological systems. He directly compares these systems, revealing the limitations of each and placing their dynamics in perspective. These include annual versus perennial systems and grasses and crops versus trees. As the subtitle indicates, the book uses a toolkit approach to help readers understand the value of selecting different practices and species appropriate to a given ecosystem. Included in the analysis of mitigation strategies are livestock systems and ways these can be managed in concert with plant systems to create viable agroecosystems to reduce the carbon footprint in agriculture. Summing Up: Recommended. All library collections.”

Booklist-

"To minimize climate change, environmental engineers have recently proposed several innovative, if controversial, schemes designed to soak up CO2 or even block sunlight altogether, including spraying aerosols in the upper atmosphere. Yet, according to permaculture expert Toensmeier, a more reliable and safer solution involves trading in conventional agriculture practices for a soil-management methodology known as carbon farming. In this weighty but well-organized handbook, Toensmeier offers a wealth of guidance on cutting-edge farming techniques that reduce greenhouse-gas emissions and capture carbon in vegetation and soils. As a successful model of what’s possible, Toensmeier cites Las Canadas, in Veracruz, Mexico, where food-cooperative owner Ricardo Romero restored 250 acres of degraded farmland within 10 years. In 5 lucidly written sections, Toensmeier covers the science of carbon sequestration, perennial crop cultivation, and key financing tips. On the coattails of the recent, successful Paris Climate Summit, Toensmeier provides invaluable information and inspiration to farmers and agricultural entrepreneurs as well as everyone interested in environmentally positive farming as part of the effort to protect food sources and mitigate global warming.”

Library Journal-

"Toensmeier (Perennial Vegetables) contends that shifting agricultural practices can help mitigate climate change and advocates for carbon farming, i.e., using a suite of perennial crops and practices that simultaneously seclude carbon in the soil while maintaining the amounts of crops needed globally for food, materials, and energy. The author delineates the different types of systems that are best at sequestering carbon and also provides strategies for livestock management, supplying general information on practices such as rainwater harvesting and terrace farming that will help guarantee the successful implementation of this type of farming. A large section is devoted to perennial crops that Toensmeier maintains would be strong candidates for carbon farming. VERDICT: Both small- and large-scale farmers will find ways to apply methods that segregate carbon and therefore lessen the deleterious effects of climate change in this comprehensive title.”

“Agriculture is currently a major net producer of greenhouse gases, with little prospect of improvement unless things change markedly. In The Carbon Farming Solution, Eric Toensmeier puts carbon sequestration at the forefront and shows how agriculture can be a net absorber of carbon. Improved forms of annual-based agriculture can help to a degree; however to maximize carbon sequestration, it is perennial crops we must look at, whether it be perennial grains, other perennial staples, or agroforestry systems incorporating trees and other crops. In this impressive book, backed up with numerous tables and references, the author has assembled a toolkit that will be of great use to anybody involved in agriculture whether in the tropics or colder northern regions. For me the highlights are the chapters covering perennial crop species organized by use—staple crops, protein crops, oil crops, industrial crops, etc.—with some seven hundred species described. There are crops here for all climate types, with good information on cultivation and yields, so that wherever you are, you will be able to find suitable recommended perennial crops. This is an excellent book that gives great hope without being naïve and makes a clear reasoned argument for a more perennial-based agriculture to both feed people and take carbon out of the air.”--Martin Crawford, director, The Agroforestry Research Trust; author of Creating a Forest Garden and Trees for Gardens, Orchards, and Permaculture

“Scientific observations and models are building an increasingly dire picture of the obstacles that must be crossed on the road to achieving climate and ecological health and stability on a planet filled with humans. The relentlessly hopeful (but not naively optimistic) author of The Carbon Farming Solution reminds us that our planet is still rich in biological resources and that humanity is capable of astonishing feats of creativity and collaborative action; the picture painted here in word and image depicts both the barriers and paths through them. Eric Toensmeier draws upon both the scientific literature and the world’s ethnobotanical knowledge bank to construct a logical and compelling road map for future research and investment to reinvent agriculture. But reason and facts alone are insufficient to sustain a global and long-term agenda; passion is required. In the end, it is the perennial plants (and their human and microbial partners) themselves—lovingly portrayed here in their glorious diversity and elegant functionality—that steal the show and our hearts. This ‘Who’s Who’ of wild or orphaned potential crops can inspire a new generation of plant lovers and gardeners to become the convention-questioning, dedicated, passionate, hopeful scientists, farmers, and leaders that the movement requires.”--David Van Tassel, PhD, senior scientist, The Land Institute

“These are exciting times for soil carbon! What was once an obscure topic mainly of interest to agronomists and gardeners is now viewed by many people as a key to solving multiple challenges in the 21st century, including climate change, hunger, and drought. For urgent times, we need an urgent agriculture. That’s exactly what we get in Eric Toensmeier’s new book—a detailed, practical explanation of how to increase carbon in our soils, written with passion and skill by a leader in regenerative agriculture. We know what to do, and with The Carbon Farming Solution we know how to do it. Let’s get going!"--Courtney White, author of Grass, Soil, Hope and Two Percent Solutions for the Planet

“Eric Toensmeier has done it again! The Carbon Farming Solution is a detailed vision that will become the go-to reference guide for everyone who is interested in an accessible toolkit showcasing global agroecological carbon farming in action. This indispensable book needs to be put in the hands of all climate-change policy makers, agrarians, and people who eat food, drink water, and breathe air. Mr. Toensmeier’s book is not ground-breaking—it is ground-healing!”--Brock Dolman, director, Permaculture Program and WATER Institute at Occidental Arts and Ecology Center

“The Carbon Farming Solution is a book we will look back upon decades from now and wonder why something so critically relevant could have been so overlooked until that time. We are told we have a choice between chemical/GMO agriculture if we want to feed the world, or we can see children starve and adopt organic agriculture as a romantic and sentimental pursuit. Really? Toensmeier describes a future that is in alignment with how life works, a scientific and sophisticated agricultural understanding of husbandry and biology that surpasses the productivity of industrial agriculture. What is phenomenal about these land-use solutions is that they are the only way we can bring carbon back home if we are to reverse climate change. The title is accurate but humble: The Carbon Farming Solution describes the foundation of the future of civilization.”--Paul Hawken, author of Blessed Unrest

“Eric Toensmeier presents a convincing argument that carbon farming is crucial to addressing global issues of the 21st century including climate change, food and nutritional insecurity, eutrophication and contamination of water, and dwindling of soil biodiversity. Implemented in a transparent manner and with payments of just and fair price based on the true societal value, carbon farming is also pertinent to alleviating poverty and addressing several Sustainable Development Goals of the United Nations. Carbon farming as a strategy is in accord with the “4 pour 1000” initiative of the French Government presented during the COP-21 Summit in Paris on December 1, 2015 and The Carbon Farming Solution is a befitting tribute to the 2015 International Year of Soils.”--Dr. Rattan Lal, Distinguished University Professor of Soil Science and director of The Carbon Management and Sequestration Center, The Ohio State University; President Elect, International Union of Soil Sciences

“The Carbon Farming Solution is a book whose time has come. This detailed documentation of regenerative practices from around the world, including principles and methods, provides a practical guide for others to follow and expand upon as humanity takes on the ‘Great Work of Our Time’—to restore the Earth’s natural systems to ecological health. The Carbon Farming Solution is of enormous importance.”--John D. Liu, founder and director, Environmental Education Media Project (EEMP)

“If we seriously put our minds to it, we could easily provide ourselves with enough food, forever; and do so in ecologically sound ways; and at the same time—a huge bonus!—trap enough carbon in the soil to tip the battle against global warming. The methods are those of agroecology—including organic farming in general, and permaculture in particular; and as Eric Toensmeier excellently describes, farmers worldwide are already on the case. So this book offers what governments at present spectacularly do not: hope.”--Colin Tudge, author of Good Food for Everyone Forever and Why Genes Are Not Selfish and People Are Nice

“Eric Toensmeier has done a hugely impressive job putting together this magnum opus. It is packed with an enormous amount of information about seven hundred plant species that have a role to play in saving the planet from land degradation and climate change, while at the same time improving the lives of millions of poor farmers, especially in the tropics and sub-tropics. The Carbon Farming Solution covers species for every use and every situation that can be assembled in infinite agroecological combinations. On top of that, the cultivation of these crops can lead to new industries in the production of food, medicines, cosmetics, and materials—creating wealth and employment. This information should be absorbed by everyone engaged in agriculture; everyone concerned about the future of the world and the well-being and health of its people; and everyone interested in protecting biodiversity. Indeed, The Carbon Farming Solution offers a path to a bright new world!”--Professor Roger Leakey, vice chairman of the International Tree Foundation and author of Living with the Trees of Life

“Eric Toensmeier is one of North America’s most inventive and scientifically-minded permaculture experimenters. In this book, he offers nothing less than a new vision for world agriculture that is more resilient, supports traditional farmers, and also helps relieve the global climate crisis. The Carbon Farming Solution offers an encyclopedic but also highly readable view of new and old carbon-trapping farming methods that can be applied around the world, and a profile of the highly adaptable, soil-enhancing perennial plant species that may just be the key to a livable human future.”--Brian Tokar, director of the Institute for Social Ecology and author of Toward Climate Justice: Perspectives on the Climate Crisis and Social Change

“The Carbon Farming Solution is an excellent reference book that convincingly explains the potential of farming practices based on perennial crops for carbon sequestration and climate change mitigation and adaptation. The numerous photographs and charts included help illustrate the food-security and multi-functionality attributes of agroforestry and other such farming systems. In addition to professionals who work on food security and climate stabilization issues, undergraduate and graduate students of these topics will find the book useful.”--Dr. P. K. Ramachandran Nair, Distinguished Professor in the School of Forest Resources and Conservation, University of Florida

“Dealing with climate change requires action on many fronts, and this book is the toolkit for making the soil itself a sponge for carbon. It’s a powerful vision, one that I’ve seen playing out in enough places to make me very hopeful it can presage major changes in our species’ use of the land.”--Bill McKibben, author of Deep Economy

“In The Carbon Farming Solution, Eric Toensmeier admirably harnesses available data with traditional wisdom to propose a practical response to climate change. Toensmeier’s solution-oriented ideas combine his clear understanding of ecology, agriculture, and the magnitude of the challenge we face with a set of agriculture-based solutions that are suited to various livelihoods, communities, and systems of production. This book will surely be a benchmark in policy-relevant knowledge.”--Dr. Cheikh Mbow, senior scientist on climate change and development, World Agroforestry Centre

Reviews and Praise

Journal of Agroecology and Sustainable Food Systems-

"Readers interested in carbon capture and climate mitigation will welcome this new resource, one of the most complete books on the market today that deals with what could be called 'carbon farming.' Although the focus is on perennial crops and systems often grouped under the topics of agroforestry, or more recently permaculture, the book also delves into creative and biodiverse annual cropping and livestock systems, new crops, and innovative designs all focused on the issue of carbon. Toensmeier is an applied ecologist with extensive experience in the Latin American tropics, and practices these principles in workshops, books, and at home. More than a reference volume, The Carbon Farming Solution is an easily read and interesting overview of this important frontier. … The appendixes to the book provide a wealth of data on species and relevant references that could keep anyone truly interested engaged for months in following up on sources and designing new systems based on these ideas. The Carbon Farming Solution is indeed a monumental project that will help guide tropical agricultural development for decades, and Toensmeier has provided a significant resource for those concerned about climate and the future.”

Choice-

"The terrestrial carbon pool is one of the most dynamic because it is directly affected by how people manage soils and implement cropping systems. The renewed interest in sequestering carbon into the soil reservoir creates a series of questions on how to introduce practices that are effective in increasing soil carbon along with providing plant resources to sustain the goods and services needed for a healthy ecosystem. In this volume, Toensmeier (Yale Univ.), co-author with David Jacke of Edible Forest Gardens, (v. 1) (CH, Jan'06, 43-2794), explores the carbon sequestration potential of different agroecological systems. He directly compares these systems, revealing the limitations of each and placing their dynamics in perspective. These include annual versus perennial systems and grasses and crops versus trees. As the subtitle indicates, the book uses a toolkit approach to help readers understand the value of selecting different practices and species appropriate to a given ecosystem. Included in the analysis of mitigation strategies are livestock systems and ways these can be managed in concert with plant systems to create viable agroecosystems to reduce the carbon footprint in agriculture. Summing Up: Recommended. All library collections.”

Booklist-

"To minimize climate change, environmental engineers have recently proposed several innovative, if controversial, schemes designed to soak up CO2 or even block sunlight altogether, including spraying aerosols in the upper atmosphere. Yet, according to permaculture expert Toensmeier, a more reliable and safer solution involves trading in conventional agriculture practices for a soil-management methodology known as carbon farming. In this weighty but well-organized handbook, Toensmeier offers a wealth of guidance on cutting-edge farming techniques that reduce greenhouse-gas emissions and capture carbon in vegetation and soils. As a successful model of what’s possible, Toensmeier cites Las Canadas, in Veracruz, Mexico, where food-cooperative owner Ricardo Romero restored 250 acres of degraded farmland within 10 years. In 5 lucidly written sections, Toensmeier covers the science of carbon sequestration, perennial crop cultivation, and key financing tips. On the coattails of the recent, successful Paris Climate Summit, Toensmeier provides invaluable information and inspiration to farmers and agricultural entrepreneurs as well as everyone interested in environmentally positive farming as part of the effort to protect food sources and mitigate global warming.”

Library Journal-

"Toensmeier (Perennial Vegetables) contends that shifting agricultural practices can help mitigate climate change and advocates for carbon farming, i.e., using a suite of perennial crops and practices that simultaneously seclude carbon in the soil while maintaining the amounts of crops needed globally for food, materials, and energy. The author delineates the different types of systems that are best at sequestering carbon and also provides strategies for livestock management, supplying general information on practices such as rainwater harvesting and terrace farming that will help guarantee the successful implementation of this type of farming. A large section is devoted to perennial crops that Toensmeier maintains would be strong candidates for carbon farming. VERDICT: Both small- and large-scale farmers will find ways to apply methods that segregate carbon and therefore lessen the deleterious effects of climate change in this comprehensive title.”

“Agriculture is currently a major net producer of greenhouse gases, with little prospect of improvement unless things change markedly. In The Carbon Farming Solution, Eric Toensmeier puts carbon sequestration at the forefront and shows how agriculture can be a net absorber of carbon. Improved forms of annual-based agriculture can help to a degree; however to maximize carbon sequestration, it is perennial crops we must look at, whether it be perennial grains, other perennial staples, or agroforestry systems incorporating trees and other crops. In this impressive book, backed up with numerous tables and references, the author has assembled a toolkit that will be of great use to anybody involved in agriculture whether in the tropics or colder northern regions. For me the highlights are the chapters covering perennial crop species organized by use—staple crops, protein crops, oil crops, industrial crops, etc.—with some seven hundred species described. There are crops here for all climate types, with good information on cultivation and yields, so that wherever you are, you will be able to find suitable recommended perennial crops. This is an excellent book that gives great hope without being naïve and makes a clear reasoned argument for a more perennial-based agriculture to both feed people and take carbon out of the air.”--Martin Crawford, director, The Agroforestry Research Trust; author of Creating a Forest Garden and Trees for Gardens, Orchards, and Permaculture

“Scientific observations and models are building an increasingly dire picture of the obstacles that must be crossed on the road to achieving climate and ecological health and stability on a planet filled with humans. The relentlessly hopeful (but not naively optimistic) author of The Carbon Farming Solution reminds us that our planet is still rich in biological resources and that humanity is capable of astonishing feats of creativity and collaborative action; the picture painted here in word and image depicts both the barriers and paths through them. Eric Toensmeier draws upon both the scientific literature and the world’s ethnobotanical knowledge bank to construct a logical and compelling road map for future research and investment to reinvent agriculture. But reason and facts alone are insufficient to sustain a global and long-term agenda; passion is required. In the end, it is the perennial plants (and their human and microbial partners) themselves—lovingly portrayed here in their glorious diversity and elegant functionality—that steal the show and our hearts. This ‘Who’s Who’ of wild or orphaned potential crops can inspire a new generation of plant lovers and gardeners to become the convention-questioning, dedicated, passionate, hopeful scientists, farmers, and leaders that the movement requires.”--David Van Tassel, PhD, senior scientist, The Land Institute

“These are exciting times for soil carbon! What was once an obscure topic mainly of interest to agronomists and gardeners is now viewed by many people as a key to solving multiple challenges in the 21st century, including climate change, hunger, and drought. For urgent times, we need an urgent agriculture. That’s exactly what we get in Eric Toensmeier’s new book—a detailed, practical explanation of how to increase carbon in our soils, written with passion and skill by a leader in regenerative agriculture. We know what to do, and with The Carbon Farming Solution we know how to do it. Let’s get going!"--Courtney White, author of Grass, Soil, Hope and Two Percent Solutions for the Planet

“Eric Toensmeier has done it again! The Carbon Farming Solution is a detailed vision that will become the go-to reference guide for everyone who is interested in an accessible toolkit showcasing global agroecological carbon farming in action. This indispensable book needs to be put in the hands of all climate-change policy makers, agrarians, and people who eat food, drink water, and breathe air. Mr. Toensmeier’s book is not ground-breaking—it is ground-healing!”--Brock Dolman, director, Permaculture Program and WATER Institute at Occidental Arts and Ecology Center

“The Carbon Farming Solution is a book we will look back upon decades from now and wonder why something so critically relevant could have been so overlooked until that time. We are told we have a choice between chemical/GMO agriculture if we want to feed the world, or we can see children starve and adopt organic agriculture as a romantic and sentimental pursuit. Really? Toensmeier describes a future that is in alignment with how life works, a scientific and sophisticated agricultural understanding of husbandry and biology that surpasses the productivity of industrial agriculture. What is phenomenal about these land-use solutions is that they are the only way we can bring carbon back home if we are to reverse climate change. The title is accurate but humble: The Carbon Farming Solution describes the foundation of the future of civilization.”--Paul Hawken, author of Blessed Unrest

“Eric Toensmeier presents a convincing argument that carbon farming is crucial to addressing global issues of the 21st century including climate change, food and nutritional insecurity, eutrophication and contamination of water, and dwindling of soil biodiversity. Implemented in a transparent manner and with payments of just and fair price based on the true societal value, carbon farming is also pertinent to alleviating poverty and addressing several Sustainable Development Goals of the United Nations. Carbon farming as a strategy is in accord with the “4 pour 1000” initiative of the French Government presented during the COP-21 Summit in Paris on December 1, 2015 and The Carbon Farming Solution is a befitting tribute to the 2015 International Year of Soils.”--Dr. Rattan Lal, Distinguished University Professor of Soil Science and director of The Carbon Management and Sequestration Center, The Ohio State University; President Elect, International Union of Soil Sciences

“The Carbon Farming Solution is a book whose time has come. This detailed documentation of regenerative practices from around the world, including principles and methods, provides a practical guide for others to follow and expand upon as humanity takes on the ‘Great Work of Our Time’—to restore the Earth’s natural systems to ecological health. The Carbon Farming Solution is of enormous importance.”--John D. Liu, founder and director, Environmental Education Media Project (EEMP)

“If we seriously put our minds to it, we could easily provide ourselves with enough food, forever; and do so in ecologically sound ways; and at the same time—a huge bonus!—trap enough carbon in the soil to tip the battle against global warming. The methods are those of agroecology—including organic farming in general, and permaculture in particular; and as Eric Toensmeier excellently describes, farmers worldwide are already on the case. So this book offers what governments at present spectacularly do not: hope.”--Colin Tudge, author of Good Food for Everyone Forever and Why Genes Are Not Selfish and People Are Nice

“Eric Toensmeier has done a hugely impressive job putting together this magnum opus. It is packed with an enormous amount of information about seven hundred plant species that have a role to play in saving the planet from land degradation and climate change, while at the same time improving the lives of millions of poor farmers, especially in the tropics and sub-tropics. The Carbon Farming Solution covers species for every use and every situation that can be assembled in infinite agroecological combinations. On top of that, the cultivation of these crops can lead to new industries in the production of food, medicines, cosmetics, and materials—creating wealth and employment. This information should be absorbed by everyone engaged in agriculture; everyone concerned about the future of the world and the well-being and health of its people; and everyone interested in protecting biodiversity. Indeed, The Carbon Farming Solution offers a path to a bright new world!”--Professor Roger Leakey, vice chairman of the International Tree Foundation and author of Living with the Trees of Life

“Eric Toensmeier is one of North America’s most inventive and scientifically-minded permaculture experimenters. In this book, he offers nothing less than a new vision for world agriculture that is more resilient, supports traditional farmers, and also helps relieve the global climate crisis. The Carbon Farming Solution offers an encyclopedic but also highly readable view of new and old carbon-trapping farming methods that can be applied around the world, and a profile of the highly adaptable, soil-enhancing perennial plant species that may just be the key to a livable human future.”--Brian Tokar, director of the Institute for Social Ecology and author of Toward Climate Justice: Perspectives on the Climate Crisis and Social Change

“The Carbon Farming Solution is an excellent reference book that convincingly explains the potential of farming practices based on perennial crops for carbon sequestration and climate change mitigation and adaptation. The numerous photographs and charts included help illustrate the food-security and multi-functionality attributes of agroforestry and other such farming systems. In addition to professionals who work on food security and climate stabilization issues, undergraduate and graduate students of these topics will find the book useful.”--Dr. P. K. Ramachandran Nair, Distinguished Professor in the School of Forest Resources and Conservation, University of Florida

“Dealing with climate change requires action on many fronts, and this book is the toolkit for making the soil itself a sponge for carbon. It’s a powerful vision, one that I’ve seen playing out in enough places to make me very hopeful it can presage major changes in our species’ use of the land.”--Bill McKibben, author of Deep Economy

“In The Carbon Farming Solution, Eric Toensmeier admirably harnesses available data with traditional wisdom to propose a practical response to climate change. Toensmeier’s solution-oriented ideas combine his clear understanding of ecology, agriculture, and the magnitude of the challenge we face with a set of agriculture-based solutions that are suited to various livelihoods, communities, and systems of production. This book will surely be a benchmark in policy-relevant knowledge.”--Dr. Cheikh Mbow, senior scientist on climate change and development, World Agroforestry Centre