Chelsea Green Authors in the News: Extra, Extra, Read All About It!

One of the most rewarding parts of our job is working with an amazing roster of authors who are not only leaders in their fields but also passionate about spreading their knowledge to the world. So, when those authors are featured in the news talking about their books, sharing wisdom and insight, and getting people excited to learn, we’re over the moon.

As 2018 comes to an end, we wanted to look back on just a few of the articles and interviews our authors took part in over the year. We hope you enjoy them as much as we do!

Book: Brew Beer Like a Yeti by Jereme Zimmerman

Outlet: PorchDrinking.com

“Eschewing hops in your beer is not the best money-making business model in American craft beer in 2018, but if you’re brewing it for yourself, who cares? Actually, those last two words form a sort of unofficial mantra for Jereme Zimmerman’s attitude toward accepted homebrewing guidelines in his new book. Learn the rules, then break them.”

Read the full article here: Brew Beer Like a Yeti Embraces the Unconventional

Book: Dirt to Soil by Gabe Brown

Book: Dirt to Soil by Gabe Brown

Outlet: OnEarth Magazine

“Sometimes enlightenment arrives as a flash of epiphany: a gravity-obeying apple that falls from a tree, for instance, or a blinding light that freezes you in your tracks on the road to Damascus.

Other times, though, it’s more of a process. That’s how Gabe Brown came to regenerative agriculture. About 20 years ago, Brown nearly lost his 1,760-acre farm outside Bismarck, North Dakota, which he had taken over upon his in-laws’ retirement in 1991. Just as his wife’s family had done since the 1950s, Brown continued to till, fertilize, graze, and chemically treat the land—all of which were considered best practices at the time.”

Read the full article here: How Did Farmer Brown Bring His Dying Land Back From the Brink?

Book: Doughnut Economics by Kate Raworth

![Kate Raworth [Photo: Bret Hartman/TED]](https://www.chelseagreen.com/wp-content/uploads/Kate-Raworth-Photo-Bret-Hartman-TED-300x230.png)

Outlet: Fast Company

“Currently, we’re overtaxing the Earth’s resources: We’re already seeing the effects of climate change, nitrogen and phosphorous loading, land conversion, and biodiversity loss. Yet at the same time, we’re failing to meet the needs that keep our foundation strong, because our economy is structured in such a way as to funnel resources and wealth toward people who already possess it. Our current growth-driven strategy will only exacerbate this dynamic.”

Read the full article here: It’s Time To Abandon Economic Growth As The Only Indicator Of Success

And here’s a link to her full TED talk as published on NPR’s TED Radio Hour.

Book: Eager by Ben Goldfarb

Book: Eager by Ben Goldfarb

Outlet: The Washington Post

“Goldfarb has built a masterpiece of a treatise on the natural world, how that world stands now and how it could be in the future if we protect beaver populations. He gives us abundant reasons to respect environment-restoring beavers and their behaviors, for their own good and for ours.”

Read the full article here: How beavers can save the world from environmental ruin

Other Eager in the headlines notes:

- Listed as one of The Washingon Post’s “50 Notable Works of Nonfiction” for 2018

- Longlisted for the PEN/E.O. Wilson Literary Science Writing Award

- A great listen: Ben Goldfarb sat down with Jenni Doering of Living on Earth

Book: Farming While Black by Leah Penniman

Outlet: National Public Radio’s The Salt

“Penniman and her staff at Soul Fire Farm, located about 25 miles northeast of Albany, train black and Latinx farmers in growing techniques and management practices from the African diaspora, so they can play a part in addressing food access, health disparities, and other social issues. Penniman’s new book, Farming While Black: Soul Fire Farm’s Practical Guide to Liberation on the Land, details her experiences as a farmer and activist, how she found “real power and dignity” through food, and how people with zero experience in gardening and farming can do the same.”

Read the full article here: ‘Farming While Black’: A Guide To Finding Power And Dignity Through Food

For more on Farming While Black check out:

- Bon Appetit – Why Farming Is an Act of Defiance For People of Color

- WNYC, The Takeaway – At Soul Fire Farm, Agricultural Activists Work to Alleviate Racial Food Injustice

Book: The Fruit Forager’s Companion by Sara Bir

Book: The Fruit Forager’s Companion by Sara Bir

Outlet: The Seattle Times

“Bir offers some practical guidelines for foraging: Is it safe? Is it legal? (“When in doubt, pick up the phone or knock on a door and ask.”) Is it for sure what you think it is? Is it morally OK? (Don’t take too much of an uncommon plant!) Is it ready to pick? She also has plenty of guidance and recipes for dealing with the peculiarities of foraged fruit — uncertain quantities, variable quality, types that aren’t bred for mass-market success.”

Read the full article here: Sara Bir offers practical guidelines, and delicious recipes, for foraged fruit

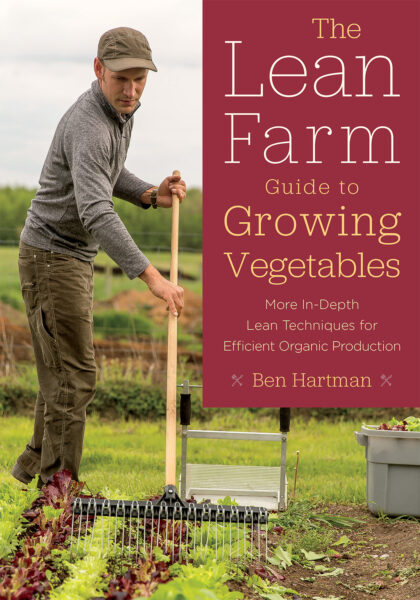

Book: The Lean Farm Guide to Growing Vegetables by Ben Hartman

Outlet: Civil Eats

“Over the last nine years, Ben Hartman’s farm in northern Indiana has become more efficient and profitable following the techniques developed by an unlikely source: Toyota.

By adapting the production techniques developed by the car manufacturer—commonly referred to as “lean manufacturing“—Hartman has revolutionized his methods, cut down his work hours dramatically, and shrunk the size of his farm, all while making a better income.”

Read the full article here: A Method for Growing a Lot of Food on Little Land

Book: Mesquite by Gary Paul Nabhan

Book: Mesquite by Gary Paul Nabhan

Outlet: Utah Public Radio

Gary Paul Nabhan is an Agricultural Ecologist, Ethnobotanist, Ecumenical Franciscan Brother, and author whose work has focused primarily on the interaction of biodiversity and cultural diversity of the arid binational Southwest. He is considered a pioneer in the local food movement and the heirloom seed saving movement.

Listen to the full interview here: Land, Food, And Bridging Social Divisions With Gary Paul Nabhan

Book: The New Organic Grower, 3rd Edition by Eliot Coleman

Outlet: Portland Press Herald

“For three decades now, Eliot Coleman’s “The New Organic Grower” has been a must-read for anyone starting a small farm. It has never gone out of print. But as the years passed, Coleman began to feel he was short-changing his readers. ‘It started bothering me that, because I learn so much every year, I had to bring it up to date,’ he said in a recent telephone interview.”

Read the full article here: Maine’s most famous organic gardener updates his classic book

Book: Oil, Power, and War by Matthieu Auzanneau

Book: Oil, Power, and War by Matthieu Auzanneau

Outlet: Resilience.org

“In Oil, Power, and War, French journalist Matthieu Auzanneau presents a comprehensive, provocative history of humankind’s relationship with oil. His account takes us from the first references to oil in ancient literature and scripture, to its current status as the lifeblood of the industrial economy, to its inevitable future demise as a usable energy source for our society. The book was first published in France in 2015 as Or noir (meaning “black gold”). This new edition is a nicely rendered English translation that extends the original narrative to the present.”

Read the full review here: Review: Oil, Power, and War by Matthieu Auzanneau

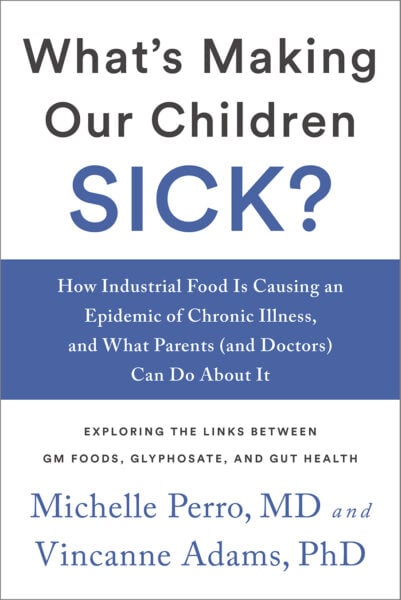

Book: What’s Making Our Children Sick? by Vincanne Adams and Michelle Perro

Outlet: Better Nutrition

“Pediatrician Michelle Perro, MD, and medical anthropologist Vincanne Adams, PhD, authors of What’s Making Our Children Sick?, believe that many of [the chronic diseases in childen] can be blamed on an environment that has been made toxic by agrochemical industrialized food production. Kids are exposed to pesticides and other foreign chemical substances both internally, through what they eat and drink, and externally, by exposure to pesticides and other substances sprayed at schools, parks, and daycare centers. And we’re only beginning to understand some of the harmful effects of these toxic chemicals.”

Read the full article here: What’s Making Our Kids Sick?

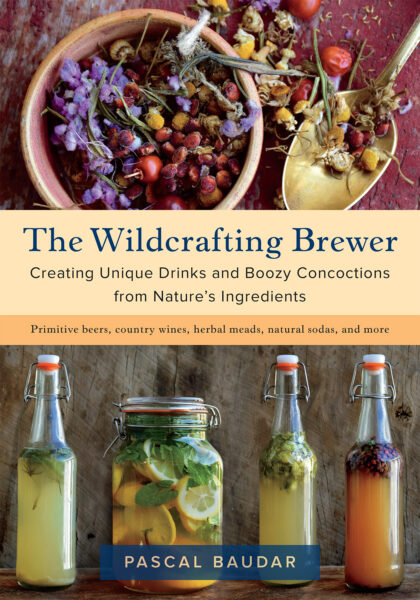

Book: The Wildcrafting Brewer by Pascal Baudar

Book: The Wildcrafting Brewer by Pascal Baudar

Outlet: The Splendid Table

“What you’re looking for will dictate the environment that you’re looking for it. I have 2,000 acres of private property, so I do all my foraging on private property. If it’s non-native, then I don’t care. I can go to a place and pick up dandelion – no one wants dandelion. And by the way, 90 percent of the things I collect are actually non-native, because the native stuff is usually very strong. Foraging can be a little bit controversial, but I look at foraging as one way to actually help the environment at the same time.”

Read the full article here: Studying the flavor of a landscape: foraging with Pascal Baudar

For more on The Wildcrafting Brewer check out:

- Forbes – How To Create Unique Drinks Using Nature’s Ingredients

- The Daily Beast – Turning Lemons and Pine Needles Into Sunshine Soda

Book: Mitochondria and the Future of Medicine by Dr Lee Know

Outlet: Mercola

“When it comes to health and disease prevention, your mitochondrial health and function simply cannot be overstated. If your mitochondria are not functioning well, nothing else will either. Optimization of mitochondria is also a central key for life extension. Dr. Lee Know, who is a naturopathic physician, has written a must-read book on this topic called Mitochondria and the Future of Medicine: The Key to Understanding Disease, Chronic Illness, Aging, and Life Itself.”

Read the full article here: What You Really Need to Know About Your Mitochondria

Book: Call of the Reed Warbler by Charles Massey

Book: Call of the Reed Warbler by Charles Massey

Outlet: KGNU

“Charles Massy is an Australian farmer, scientist and proponent of regenerative agriculture. While in Boulder this month, where he was part of the Regenerative Earth Summit, he sat down with KGNU to talk about his new book Call of the Reed Warbler, A New Agriculture, A New Earth.”

Listen to the full interview here: Call of the Reed Warbler: A New Agriculture, A New Earth

Book: Nourishment by Fred Provenza

Outlet: The Permaculture Podcast

“Drawing on decades of research with animals, upon retirement from Utah State University he turned his lens towards human beings to pull together the best studies and his own personal journey to provide a way we can begin to eat well for ourselves by outlining where we’ve gone wrong and what we can do to make a positive change.”

Listen to the full interview here: Reclaiming our Nutritional Wisdom: Nourishment with Fred Provenza

Recent Articles

Garlic mustard: while known as “invasive,” this plant can be consumed in its entirety and has great nutritional value. Plus, the garlic-flavor is a perfect addition to any recipe that calls for mustard! The following are excerpts from Beyond the War on Invasive Species by Tao Orion and The Wild Wisdom of Weeds by Katrina…

Read MoreEveryone loves a refreshing, fermented, nutritious drink…even your garden! Take your fermentation skills out of the kitchen and into the garden by brewing fermented plant juice. The following is an excerpt from The Regenerative Grower’s Guide to Garden Amendments by Nigel Palmer. It has been adapted for the web. How to Make Fermented Plant Juice Fermented…

Read MorePeregrine falcons, while known as predators, are essential to our environment. These stunning birds have a rich history, an interesting present, and an uncertain future. The following is an excerpt from Feather Trails by Sophie A. H. Osborn. It has been adapted for the web. Who Are Peregrine Falcons? Though relatively uncommon wherever it occurs,…

Read MoreOh, honeysuckle…how we love thee. If only there was a way to capture the sweet essence of this plant so we could enjoy it more than just in passing. Luckily, foraging and some preparation can help make that happen! Here’s a springtime recipe that tastes exactly like honeysuckle smells. The following excerpt is from Forage,…

Read MoreWant to see your crops thrive this upcoming growing season? The key is in soil fertility and health. Spend time maintaining your soil’s health to guarantee bigger and better crops come harvest time! The following is an excerpt from No-Till Intensive Vegetable Culture by Bryan O’Hara. It has been adapted for the web. What Is Soil Fertility?…

Read More