How to Start Seedlings in a Cold Frame: Gardening Tips from Eliot Coleman

Are you ready to get a jump-start on the gardening season? With a cold frame, you can get started now. A cold frame harnesses the sun’s heat before it’s warm enough to let unprotected seedlings growing outside.

Essentially, it consists of a garden bed surrounded by an angled frame and covered with a pane of glass. All but the most heat-loving vegetables (like tomatoes and peppers) can be started in a cold frame. The biggest advantage of growing with a cold frame is that your plants can get in the soil right away, without enduring the unnecessary stress of having their roots constricted in trays.

The following excerpt is from Four-Season Harvest by Eliot Coleman. It has been adapted for the web.

(All illustrations by Kathy Bray. Cover photo courtesy of Barbra Damrosch.)

Your cold frame can serve as a greenhouse for starting seedlings.

You can use it for all seedlings that are transplanted except the early-spring sowings of heat-lovers such as tomatoes, peppers, and cucumbers. They should be started in a sunny window in the house. For all the others, the cold frame is an ideal place to start growing. Once you begin raising seedlings in the cold frame, you will find it so simple and successful that you will never go back to flats on windowsills. Here’s how to do it:

Spread potting mix about two to three inches deep in whatever part of a frame you wish to use for seedlings. Lay 3-inch boards around the edge as a border, then treat that area as if it were a flat: make furrows, drop in evenly spaced seeds, cover them shallowly, mark them with name and date on a small stake, and water them lightly with a fine sprinkler. The rows can be as close together as they would be in a flat. Space seeds evenly in the seeding row so they won’t be crowded. We always try to avoid plant stress at all stages of growing. It takes a little more time, but the results are worth it.

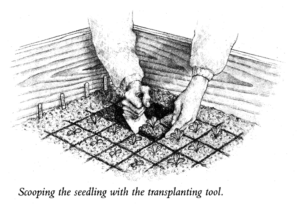

When the seedlings are up, move them to an adjoining section of the frame, which also has a 2 inch covering of potting mix over the soil. Do this as soon as you can handle the seedlings. Within reason, the younger you transplant a seedling, the better. Dig under each one with a small, pointed dowel, lifting and loosening the roots as you extract them from the soil. Always be gentle with seedlings. Hold them by a leaf, not the stem, so you don’t crush the vital parts if you squeeze too hard.

When the seedlings are up, move them to an adjoining section of the frame, which also has a 2 inch covering of potting mix over the soil. Do this as soon as you can handle the seedlings. Within reason, the younger you transplant a seedling, the better. Dig under each one with a small, pointed dowel, lifting and loosening the roots as you extract them from the soil. Always be gentle with seedlings. Hold them by a leaf, not the stem, so you don’t crush the vital parts if you squeeze too hard.

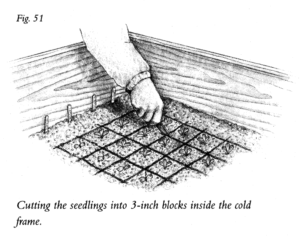

Poke holes in the potting soil of the adjoining section with the dowel to make space for the roots, then tuck them in lightly. A good distance for all seedlings is 3 inches apart. When they are large enough to transplant to the garden, use a knife to cut the soil into cubes with a seedling in the center of each. It is just like cutting a tray of brownies. If you make sure the soil is moist (sprinkle if necessary before cutting), the blocks will hold together nicely. You can use a bricklayer’s or right-angle trowel to slice underneath each cube, lift it out, and set it in a tray for transport to its permanent garden home.

There are many advantages to growing seedlings in a cold frame

No flats are necessary. There is no potting soil mess in the house. The seedlings will be hardy because the cold frame is not artificially heated. Any additional hardening off is easily accomplished by opening the lights slightly wider.

No flats are necessary. There is no potting soil mess in the house. The seedlings will be hardy because the cold frame is not artificially heated. Any additional hardening off is easily accomplished by opening the lights slightly wider.

Finally, watering is more forgiving, since your seedlings are connected to the earth and they can’t dry out as quickly as they can in the limited confines of a flat. Thus, an occasional lapse in watering is not disastrous.

The intermediate transplanting from the seedling row to the 3-by-3-inch spacing makes transplanting seedlings a two-step process. We think it’s worth the effort because the intermediate step has been found to stimulate increased root regrowth, resulting in slightly more vigorous transplants. You can do it as a one-step process by simply starting out with the 3-by-3-inch configuration and planting three seeds in each square. After they emerge, you thin to the best one in each square and proceed as before.

With some crops, we use a Dutch idea called multiplants and sow four or more seeds in each square with no intention of thinning them. This allows us to grow transplants in groups rather than as singles. The onion crop will serve as a good example of how to go about it. Sow five seeds together. Plan for four of the seeds to germinate. When the onion seedlings are large enough to go to the garden, cut out the blocks as usual and set them out at a spacing of 10 by 12 inches.

With some crops, we use a Dutch idea called multiplants and sow four or more seeds in each square with no intention of thinning them. This allows us to grow transplants in groups rather than as singles. The onion crop will serve as a good example of how to go about it. Sow five seeds together. Plan for four of the seeds to germinate. When the onion seedlings are large enough to go to the garden, cut out the blocks as usual and set them out at a spacing of 10 by 12 inches.

If you were growing single plants in rows they would be set 3 inches apart. Four plants in a clump every 12 inches in a row is the same average spacing as one plant every 3 inches. Each onion is allowed just as much total garden space,and the yield is the same. The onions growing. together push each other aside gently and at harvest time are lying in a series of small circles rather than single rows. If all the seeds germinate and there are five onions in each clump, that’s no problem.

In addition to onions, you can use the multiplant technique for early transplants of beets, broccoli, cabbage, leeks, scallions, and spinach. Not only is this system more efficient because four plants can be transplanted as quickly as one, but it also can be used to control size when desired. A clump of broccoli, for example, will yield three or four smaller central heads rather than one large one. For many families, the smaller unit size is more desirable.

Recommended Reads

Build Your Own Cold Frame: Get a Jump on the Planting Season

Recent Articles

With the right strategies and practices, composting on a small farm is surprisingly easy and inexpensive. Just follow these steps for making compost, and your farm will be thriving in no time! The following excerpt is from The Lean Farm Guide to Growing Vegetables by Ben Hartman. It has been adapted for the web. (All photographs by Ben…

Read MoreGarlic mustard: while known as “invasive,” this plant can be consumed in its entirety and has great nutritional value. Plus, the garlic-flavor is a perfect addition to any recipe that calls for mustard! The following are excerpts from Beyond the War on Invasive Species by Tao Orion and The Wild Wisdom of Weeds by Katrina…

Read MoreEveryone loves a refreshing, fermented, nutritious drink…even your garden! Take your fermentation skills out of the kitchen and into the garden by brewing fermented plant juice. The following is an excerpt from The Regenerative Grower’s Guide to Garden Amendments by Nigel Palmer. It has been adapted for the web. How to Make Fermented Plant Juice Fermented…

Read MoreWant to see your crops thrive this upcoming growing season? The key is in soil fertility and health. Spend time maintaining your soil’s health to guarantee bigger and better crops come harvest time! The following is an excerpt from No-Till Intensive Vegetable Culture by Bryan O’Hara. It has been adapted for the web. What Is Soil Fertility?…

Read MoreMany know the effects of catnip on our feline friends, but few realize that catnip has medicinal effects for humans. From stomach aches to reducing fevers, catnip is a versatile herb with many benefits. The next time you grow this plant for your cat you may end up taking a few cuttings for yourself! The…

Read More