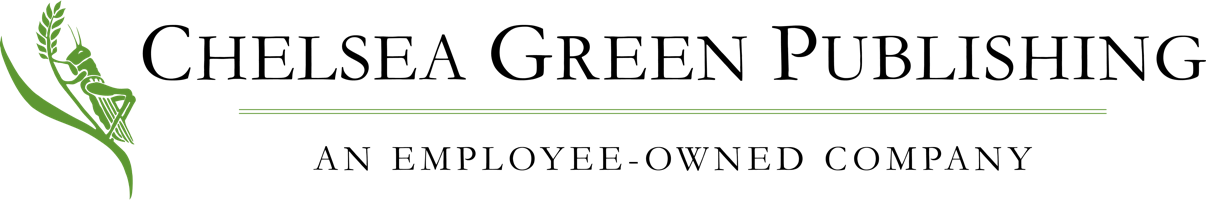

Flawed Studies, Misleading Advice, and the Real Science of Human Metabolism

Richard David Feinman, PhD, is a professor of cell biology at the State University of New York Downstate Medical Center in Brooklyn, where he has been a pioneer in incorporating nutrition into the biochemistry curriculum. Dr. Feinman is the founder and former coeditor-in-chief (2004–2009) of the journal Nutrition & Metabolism. He’s currently researching the application of ketogenic diets to cancer.

The following is an excerpt from Nutrition in Crisis by Richard Davis Feinman. It has been adapted for the web.

What should I eat? This question invariably comes up during my lectures to medical students, during presentations at conferences, and even in private conversations about scientific experiments. Depending on my audience, I will go into different levels of technical detail, but the bottom line is always the same: The best diet is the one that works. Any expert can tell you how their diet theoretically conforms to widely accepted science, and how it is “healthy,” “moderate,” and a “bargain”—but if it doesn’t work in practice, if you don’t lose weight, if your blood sugar doesn’t go down, then it’s no good at all.

There is little evidence that the diets recommended by government and private health agencies have provided much help for the current epidemic of obesity and diabetes, but they keep pushing them anyway. Defenders usually tell you that it is because people are not really following the guidelines. What they don’t say is how they know the recommendations are good if nobody follows them.

So here I’ll give you three basic rules of nutrition that I propose as a guide, and I’ll show you a few principles that will help you follow them.

So here I’ll give you three basic rules of nutrition that I propose as a guide, and I’ll show you a few principles that will help you follow them.

Rule 1. If you’re OK, you’re OK.

Rule 2. If you want to lose weight, don’t eat. If you have to eat, don’t eat carbs.

Rule 3. If you have diabetes or metabolic syndrome, carbohydrate restriction is the “default” approach—that is, the one to try first.

The story of nutrition has proved to be an almost unbelievable tale of poor and irresponsible science within the medical community, one of the most respected parts of our society. However hard it is for scientists to distrust experts, it is even harder for the general population. I was astounded when I saw a question on an online diabetes site that said, “My morning oatmeal spikes my blood glucose. How much carbohydrate should I have?”

People with diabetes cannot adequately metabolize dietary carbohydrate (starch and sugar) so it seemed like an easy question. The answer from the experts, however, was waffling and tedious, and it didn’t include the obvious advice: “Limit your oatmeal consumption to a level that doesn’t spike your blood glucose.”

Recommended Reads

Tea for Diabetes and Obesity: Herbal Formulas for Metabolic Conditions

Recent Articles

Many know the effects of catnip on our feline friends, but few realize that catnip has medicinal effects for humans. From stomach aches to reducing fevers, catnip is a versatile herb with many benefits. The next time you grow this plant for your cat you may end up taking a few cuttings for yourself! The…

Read MoreWhether you’re looking to replace your end-of-the-day cocktail, relax before bed, or want something new to add to your tea, this non-alcoholic mocktail syrup base will do the trick. Delicious and all-natural, take a sip of this nightcap mocktail and feel your troubles melt away. The following is an excerpt from Herbal Formularies for Health…

Read MoreSurprisingly, medicine can actually be delicious. This anti-inflammatory smoothie uses natural (and tasty!) ingredients to help reduce inflammation caused by any number of circumstances. The following is an excerpt from Herbal Formularies for Health Professionals, Volume 4 by Jill Stansbury. It has been adapted for the web. RECIPE: Ginger and Pineapple Anti-Inflammatory Smoothie This is an all-purpose…

Read MoreMake your own delicious, healthy, probiotic sauerkraut! Four easy steps are all you need to turn fresh garden veggies into a long-lasting, tangy, pungent condiment. The following excerpt is from The Art of Fermentation by Sandor Ellix Katz. It has been adapted for the web. 4 Simple Steps to Making Sauerkraut The English language does…

Read MoreDo you love Cheez-Its, but not the nutrition facts? Try your hand at this healthier, homemade version. These crunchy, cheesy snacks are not only ridiculously yummy, they’re also very easy to make! The following recipe is from The Heal Your Gut Cookbook by Hilary Boynton and Mary G. Brackett. It has been adapted for the web. RECIPE:…

Read More