The Carbon Farming Solution: Q&A With Eric Toensmeier

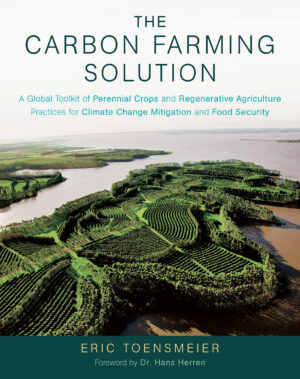

A Q&A with Eric Toensmeier, author of The Carbon Farming Solution: A Global Toolkit of Perennial Crops and Regenerative Agriculture Practices for Climate Change Mitigation and Food Security.

Q: “Carbon farming” is a term that isn’t yet widely recognized in the mainstream. And even among people who are familiar with the term, not everyone agrees on what “carbon farming” means. How do you define it?

A: Carbon farming is a suite of agricultural practices that sequester carbon in the soil or in the biomass of perennial plants, including trees. Combined with a vast reduction in fossil-fuel emissions, carbon farming has the potential to bring our atmosphere back to the magic number of 350 parts per million of carbon dioxide. In other words, the potential of carbon farming is huge. If you examine this vast potential for mitigating climate change, its importance is on par with that of renewable energy.

In terms of the practices, there’s a huge range. When I first started working on this book, I thought it would be primarily agroforestry and perennial cropping practices. But while those are both crucially important tools, you can also sequester carbon with some improved annual cropping practices, as well as grazing strategies such as intensive silvopasture, not to mention agroforestry practices such as alley cropping, contour hedgerows, windbreaks, and living fences. This is good news because it means there are crops and practices for all climates and situations (although it is important to recognize that so far the potential of carbon farming can best be felt in the tropics). Maybe the practice that best epitomizes carbon farming is the tropical homegarden, a small-scale intensive type of multistrata agroforestry that may date back as far as 13,000 years in Southeast Asia.

In some definitions, farmers must be paid for a practice in order for it to be considered carbon farming. I don’t consider that necessary to the definition; however, it is clear to me that there’s a financial component to carbon farming: it can’t succeed as an effective tool in mitigating climate change without the kind of small-scale financial incentives that make it viable for individual farmers and the kind of large-scale financial policies that signal a real commitment from governments around the world.

Q: So it’s a solution to climate change?

A: Yes, and it’s a powerful solution to climate change. This book offers—for the first time—an aggregation of best practices and partner crops, along with available data on sequestration rates.

But because carbon farming does so much more than sequester carbon, it’s also a powerful solution to many other overwhelming 21st century problems. For example, sequestering carbon in the soil builds organic matter, which improves pest and disease resistance. Organic matter also increases the land’s capacity to hold water, which helps farms withstand drought.

Many of the practices I describe in the book can also build social and economic resilience by providing long-term, perennial crops that benefit, rather than damage, the surrounding ecosystem and community. For this reason, I consider carbon farming to be a “multifunctional” solution. Contrast it with some of the geoengineering strategies that have been proposed—they don’t offer these kinds of co-benefits or feedbacks, which to me is an indication that some geoengineering strategies have been developed with the kind of reductionist, short-term thinking that got us into the climate change mess to begin with.

In some ways, I think the most powerful “solution” carbon farming might offer is as a tool to fight for climate justice. Because many carbon farming practices are most effective in the tropics—at least until we make more progress in breeding and rediscovering more cold-tolerant perennial crop varieties—carbon farming provides an opportunity for wealthy countries to pay their “carbon debt” by helping to fund widespread adoption of practices such as tree intercropping, silvopasture, multistrata agroforestry, and perennial crops throughout the tropics.

Q: In the book, you stress that farmers are already carbon farming around the world, especially in the Global South. Can you give an example of really effective carbon farming you’ve seen in action?

A: The best carbon farming site I’ve seen in the world is Las Cañadas, an amazing farmer cooperative in Veracruz, Mexico. There you can see almost all of the carbon farming practices profiled in the book in one place. (I describe it in the introduction.) First, they are growing annual crops in a sustainable fashion, including bio-intensive production. Second, they are integrating annual crops with perennials in contour hedgerow and alley cropping systems. Third, they are managing grazing livestock in ways that build soil carbon. Fourth, they are integrating trees into their pastures on a large scale. Fifth, they are emphasizing perennial crops like bamboo for staple food and for industrial purposes. Sixth, some of those perennial crops are raised in multistrata systems, the epitome of carbon sequestration.

Q: If people are already practicing carbon farming around the world, what needs to happen in order for it to become “on par” with renewable energy as a climate change mitigation strategy?

A: I think this is already beginning to happen. I was fortunate to be in Paris for COP21 and really saw for the first time that agriculture was part of the climate solutions conversation—from talking to people on the street to presentations at the highest levels of government negotiation. I think a lot of education and advocacy still needs to be done so that we think of carbon farming right alongside solar panels and windmills every time we think of climate solutions. It’s important to point out that not all carbon farming systems are equal in terms of their sequestration potential, so it’s important to integrate agroforestry and tree crops into existing organic farming, managed grazing, and conservation agriculture operations. I hope this book will provide a powerful tool for that effort.

Q: What about North America? Can you provide some examples of carbon farming in the United States? What can we learn from them?

The United States is relatively far behind in adopting carbon farming practices compared to many other countries around the world. This is particularly true in terms of practices that incorporate trees, which generally have the highest levels of carbon sequestration. There is, of course, great work being done here with managed grazing, organic annual crop production, and we also have fairly large-scale adoption of conservation agriculture (an unfortunately chemical-intensive model with low levels of carbon sequestration, which is nonetheless significant due to the scale at which it is practiced). There is some agroforestry being practiced here, mostly in the form of strip intercropping (also referred to as alley cropping) and silvopasture.

But the United States is also leading the way in some regards, especially in the development of up-and-coming practices. For example, The Land Institute is an organization based in Salina, Kansas, that has been developing perennial cultivars of annual grains. When those are available, it will be quite significant. There is also remarkable work being done by Badgersett Research Corporation in Minnesota, an organization that is incredibly ahead of its time. They have been working since the 1980s to develop woody staple-crop polycultures to replace annual staples for the purpose of climate change mitigation. I cover their work, and the work of The Land Institute, in the book.

Q: There is an incredible photo on the cover of the book. Can you explain where that is and what it epitomizes about carbon farming?

A: The cover is an aerial photograph of a farm in Uruguay. Citrus trees are being inter-cropped with timber trees (possibly eucalypts) that are also serving as a windbreak. This is a simple, commercial-scale example of a multistrata agroforestry system, in which two or more different species of trees of different heights are grown together. This kind of agriculture has the highest annual rates of carbon sequestration of any kind of farming. It also has the largest potential for long-term soil storage of carbon of any farming system. And it’s just an absolutely lovely shot that evokes a new kind of agriculture.

Q: What do you think is the most effective tool in the carbon farming toolkit?

A: In terms of having the highest annual rates of carbon sequestration and the greatest long-term soil carbon storage, you can’t beat multistrata agroforestry. These systems incorporate multiple layers of trees, shrubs, vines, and herbaceous species, and while they are still fairly new and small-scale in cold climates, they are very widely practiced in the tropics and have been for thousands of years. Developing commercial-scale models for cold climates should be a high priority of carbon farming practitioners, funders, and researchers. On the livestock end, silvopasture systems, in which trees are incorporated in pastures, are by far the most powerful.

However, maximum carbon sequestration should not be the only criteria by which to select practices. First of all, not all of them are suited to every climate or slope or soil. Second, a given region is likely to need to produce a variety of products including annual crops, livestock, timber, and perennial crops. Other ecosystem services may be important, as are a variety of other social and ecological considerations.

Q: You talk about how you had to really reconsider your understanding of things during the course of research and writing this book. What’s an example of something you thought was true before writing the book that you then developed a different—or at least more nuanced—understanding of as you wrote it?

A: I suspect this book will contain something to make almost any reader upset for one reason or another. This is also true of me, as many of my cherished assumptions were dashed against the cold hard facts as I researched and wrote. For example, I’m a huge fan of perennial crops, which do indeed sequester great amounts of carbon. However, in my research I learned that in the cold climate where I live there are not yet any perennial staple crops, even chestnuts and hazelnuts, which are currently yielding at a level competitive with annual staples like wheat and corn (though the reverse is true in the tropics). Likewise, I found that grass-based farming of livestock isn’t as promising as it’s been made out to be, although it certainly has an important role to play. I was also shocked to learn that much local agriculture actually has a worse carbon footprint than shipping food from overseas, although I lay out case studies and strategies that show that this does not have to be the case. I was also very surprised at how widespread tropical agroforestry already is—it makes the achievements of my own temperate permaculture movement seem tiny in comparison!

Q: What needs to happen in order for us to really unleash the potential for carbon farming to provide a significant impact in mitigating climate change?

I see a couple of key leverage points for rapidly scaling up carbon farming practices—where we should focus our energy and our capital. One is to remove subsidies and international trade policies that favor unsustainable agriculture and replace them with policy incentives at the national and international level to encourage the adoption of carbon farming.

Two is the development of a robust, diverse constellation of financing options, including loans, payment for environmental service programs, and grants to enable farmers to overcome the economic challenges they face in the first three to five years or more of establishing most carbon farming systems.

I’d also like to see a certification system analogous to organic that would provide a price premium for early-adopting farmers who are practicing carbon-friendly agriculture. Finally, there is an immense need for research, education, and propagation of key perennial crops. I cover all of this in greater detail in the book.

Recommended Reads

An Interview With Eliot Coleman: The Original Organic Pioneer

Recent Articles

Garlic mustard: while known as “invasive,” this plant can be consumed in its entirety and has great nutritional value. Plus, the garlic-flavor is a perfect addition to any recipe that calls for mustard! The following are excerpts from Beyond the War on Invasive Species by Tao Orion and The Wild Wisdom of Weeds by Katrina…

Read MoreEveryone loves a refreshing, fermented, nutritious drink…even your garden! Take your fermentation skills out of the kitchen and into the garden by brewing fermented plant juice. The following is an excerpt from The Regenerative Grower’s Guide to Garden Amendments by Nigel Palmer. It has been adapted for the web. How to Make Fermented Plant Juice Fermented…

Read MoreWant to see your crops thrive this upcoming growing season? The key is in soil fertility and health. Spend time maintaining your soil’s health to guarantee bigger and better crops come harvest time! The following is an excerpt from No-Till Intensive Vegetable Culture by Bryan O’Hara. It has been adapted for the web. What Is Soil Fertility?…

Read MoreMany know the effects of catnip on our feline friends, but few realize that catnip has medicinal effects for humans. From stomach aches to reducing fevers, catnip is a versatile herb with many benefits. The next time you grow this plant for your cat you may end up taking a few cuttings for yourself! The…

Read MoreIt’s time to take control of your seeds and become a plant breeder! Saving your seed allows you to grow and best traditional & regional varieties, and develop more of your own. The following excerpt is from Breed Your Own Vegetable Varieties by Carol Deppe. It has been adapted for the web. Becoming A Plant…

Read More