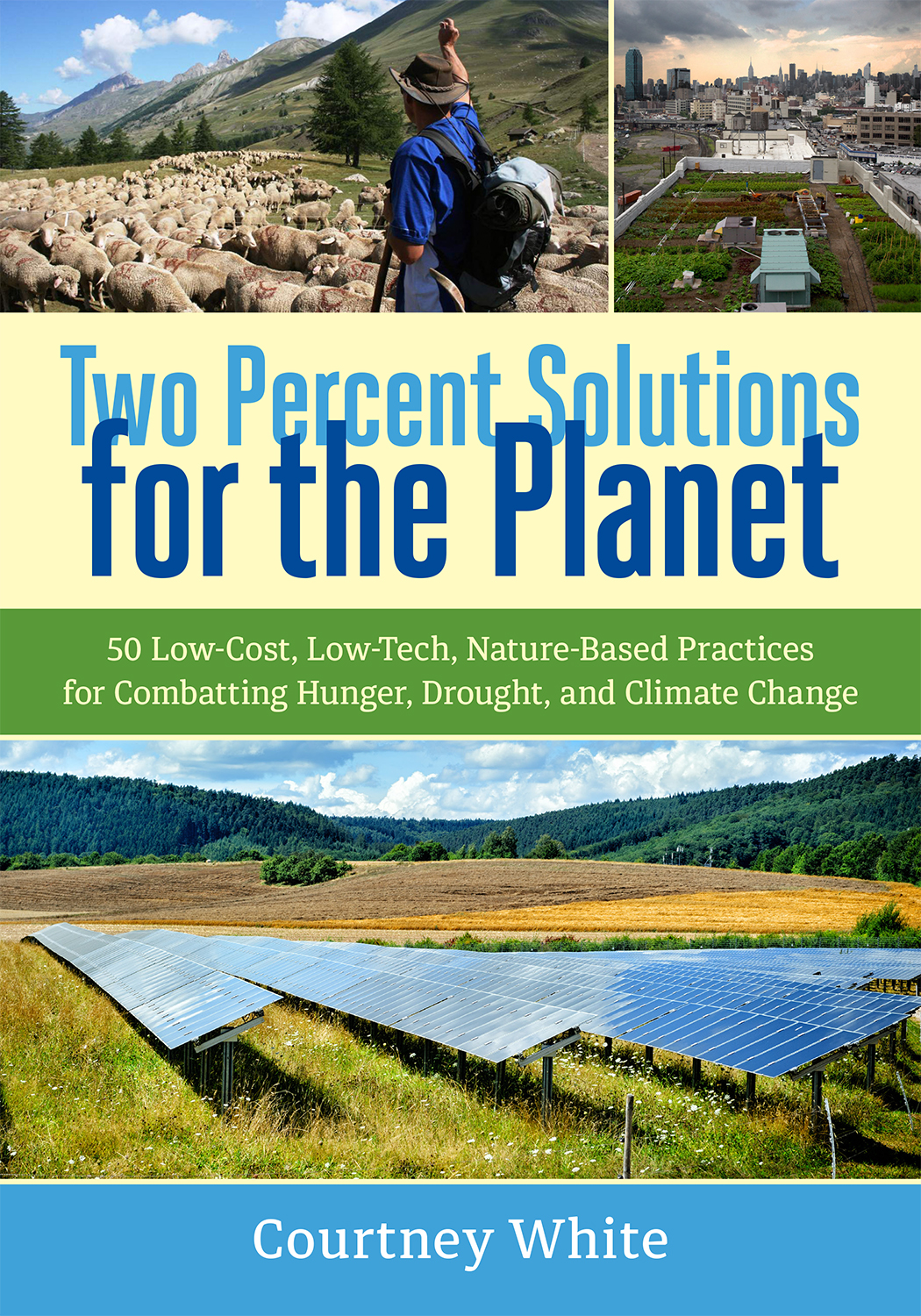

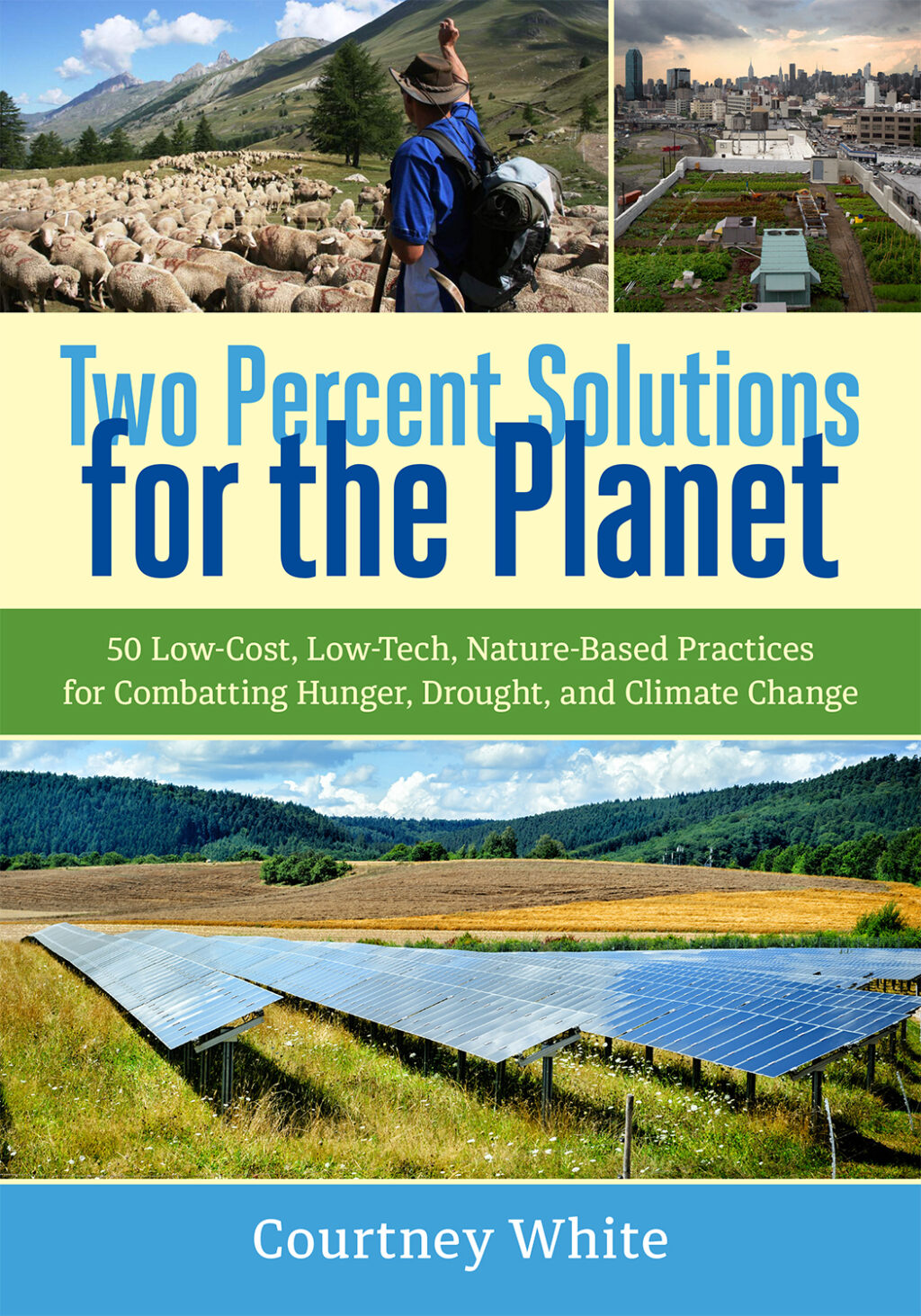

Two Percent Solutions for the Planet

50 Low-Cost, Low-Tech, Nature-Based Practices for Combatting Hunger, Drought, and Climate Change

| Pages: | 240 pages |

| Book Art: | Color photos, charts, graphs, and illustrations |

| Size: | 7 x 10 inch |

| Publisher: | Chelsea Green Publishing |

| Pub. Date: | October 8, 2015 |

| ISBN: | 9781603586177 |

Two Percent Solutions for the Planet

50 Low-Cost, Low-Tech, Nature-Based Practices for Combatting Hunger, Drought, and Climate Change

Two Percent Solutions for the Planet profiles fifty innovative practices that soak up carbon dioxide in soils, reduce energy use, sustainably intensify food production, and increase water quality. The “two percent” refers to: the amount of new carbon in the soil needed to reap a wide variety of ecological and economic benefits; the percentage of the nation’s population who are farmers and ranchers; and the low financial cost (in terms of GDP) needed to get this work done.

As White explained in Grass, Soil, Hope, a highly efficient carbon cycle captures, stores, releases, and recaptures biochemical energy, mitigating climate change, increasing water storage capacities in soil, and making green plants grow. Best of all, we don’t have to invent anything new—a wide variety of innovative ideas and methods that put carbon back into the soil have been field-tested and proven to be practical and profitable. They’re mostly low-tech, too, relying on natural resources such as sunlight, green plants, animals, compost, beavers, creeks, and more.

In Two Percent Solutions for the Planet, White expands what he calls the “regenerative toolbox,” to include holistic grazing, edible forests, biochar, weed-eating livestock, food co-ops, keyline plowing, restoration agriculture, bioenergy, aquaponics, animal power, Farm Hack, bees, bears, wildlife corridors, rainwater harvesting, native seeds, and various other projects from across the United States, as well as in Canada, Europe, and Australia. These short, engaging success stories will help readers connect the dots between diverse, exciting, and pragmatic practices, and inspire them to dig deeper into each individual story and concept, energized by the news that solutions do exist.

Reviews and Praise

Foreword Reviews-

"Two Percent Solutions for the Planet takes a clever approach to environmental problems. Rather than look at overarching solutions, Courtney White compiles fifty examples of effective, relatively small-scale success stories from around the world—all of which have made a positive impact on the environment and climate. In one example, he looks at the use of beetles to quickly turn manure into fertilizer. He describes an Australian farm’s experience grazing cattle alongside sheep, replenishing the land while simultaneously raising the animals on a healthy grass diet. Another project involved using natural materials like sticks and stones to improve a creek’s flow. The fifty examples show a nice range of innovative solutions that can be replicated, with results that benefit the planet as well as a specific farm, ranch, or other piece of land. The book’s title comes from the notion that all these solutions could be implemented for a tiny fraction of GDP, and each of the fifty examples includes links and resources for additional information about how to implement them."

More Reviews and Praise

Shelf Awareness-

"Eliminating pesticides, sequestering carbon, making healthy food available to the poor and harvesting rainwater are some of the many positive goals of the 50 regenerative practices Quivira Coalition co-founder Courtney White (The Age of Consequences) outlines in Two Percent Solutions for the Planet. White organizes these green ideas into five sections--ranching, farming, technology, restoration and wildness--includes pictures and charts to help illustrate and provides information on how readers can learn more about each concept. The common theme underlying them all, however, is 'nature knows best.' Including organic no-till, year-round farming, flerds (the co-existence of range animals) and 'poop 'n’ stomp' (using livestock to regrow grass), the solutions return the work to natural processes. White believes, 'sometimes innovation isn't a thing, a practice, or a new technology, but simply a different way of looking at the world.’ While Two Percent Solutions for the Planet would make an excellent resource for any agri-science program, it's also an enlightening reading experience for city dwellers and others far from agrarian lifestyles. Understanding processes described in the book can inform buying decisions, community involvement, even backyard gardening practices--all of which can help combat some of the world's most pressing environmental issues while simultaneously treating the planet with kindness and respect. Two Percent Solutions for the Planet is easy to understand, fascinating and enjoyably educational. Whether readers are entrenched in agricultural business or simply interested in sustainability, there's plenty to glean from White's collection of innovative practices.”

Publishers Weekly-

"In this brief work, White (The Age of Consequences), conservationist and cofounder of the Quivira Coalition, sketches 50 strategies for improving the environment and fighting hunger. Few of these strategies are aimed at the planet’s urbanized majority; while chapters dealing with rooftop gardens or aquaponics may inspire city-dwellers, most of the four-page chapters give short overviews of tactics that will primarily be useful to farmers, ranchers, and policymakers who deal directly with the land. White repeatedly refers to the writings of Aldo Leopold and is also fond of creek reclamation specialist Bill Zeedyk, who urges those attempting to restore watersheds to 'think like a creek.' White stresses the importance of improving the quality of watercourses and the ability of soil to retain carbon, thus mitigating climate change. The section ‘Wildness' addresses a range of wildlife, including such different creatures as the dung beetle and the beaver. Since each solution receives swift treatment, White isn’t able to give detailed instructions, but each segment includes online and print resources for further reference. White offers a good starting place for agriculturalists looking for ways to improve their farms and ranches, as well as the larger environment. Color photos.”

“Courtney White chronicles a new and critically important sphere of knowledge: a world of soil, sun, sky, and animals where good people regenerate the earth in ancient and novel ways. Reading about the environment rarely brings one as many smiles and as much joy as Two Percent Solutions for the Planet.”--Paul Hawken, author of Blessed Unrest; coauthor of Natural Capitalism

“Courtney White has written one of the most important books for our time about how to reverse climate change and nourish the world with abundant, healthy food. Most importantly, he describes proven, ‘shovel-ready’ solutions that progressive ranchers and farmers are doing every day. There is no need to spend billions of dollars on new, unproven technologies such as carbon capture and geoengineering. For a fraction of the cost, the world easily could scale up the regenerative practices profiled in Two Percent Solutions for the Planet. Too good to be true? Read this book and make up your own mind.”--André Leu, president of IFOAM-Organics International and author of The Myths of Safe Pesticides

“The problems that humanity faces today are the sum total of billions of small missteps. Courtney White focuses on the solutions that will arise from billions of small right steps, and the most important step is the next one that each of us takes. We may never convince seven billion souls to plant one tree at a time, over and over for the rest of their lives, but each one of us can make that commitment if we choose. Two Percent Solutions for the Planet shows us a broad pattern for healing the earth that is elegant in its simplicity. We can reforest our world, restore grasslands, sequester carbon, build soil, purify water, provide wildlife habitat, feed humanity, and improve health and nutrition while creating the ecological abundance of the future. Bravo, Courtney!”--Mark Shepard, author of Restoration Agriculture

“Courtney White’s Two Percent Solutions for the Planet features good sense paired with 50 solutions to our planet’s ills, especially those related to carbon. While each solution could be a book in itself, these short profiles may well be the way many people first discover that such solutions are in the offing. It’s a brilliant way to inform readers so that they’ll prick up their ears when they encounter possible actions based on solutions such as these. This accessible, hope-filled, and beautifully crafted book should be in every school—if not simply everywhere.”--Deborah Madison, author of Vegetable Literacy

"Courtney White takes a sharp turn away from despair over climate disruption and toward the inexorable logic of ecosystem restoration—working with nature to bring the carbon and water cycles back into balance, thereby addressing the central challenges of our time. Along the way he introduces readers to a spirited cast of farmers, ranchers, thinkers, and tinkerers. The lively profiles of innovators show us what’s possible; Courtney’s narration tells us why this matters. I dare anyone to read this book and not come away feeling hopeful and energized!”--Judith D. Schwartz, author of Cows Save the Planet

“This book is Courtney White’s most important work. It is the best practical guide to how we can begin to address the significant, unavoidable challenges awaiting us in our not-too-distant future. Two Percent Solutions for the Planet inspires us to address these challenges creatively, especially with respect to our food and agriculture future, and to do it in cooperation with nature in ways that also heal the planet. The solutions Courtney describes are not just ideas but are demonstrated strategies already being implemented by creative farmers, ranchers, ecologists, and designers. This book is a must-read for anyone interested in practical ways to restore the planet’s health while experiencing a flourishing life.”--Frederick Kirschenmann, author of Cultivating An Ecological Conscience: Essays From a Farmer Philosopher

"The two percents really add up in this glorious presentation of how to make ranching, agriculture, and the great outdoors a major force for addressing our gravest threat: climate change. Courtney White truly knows these solutions, having helped pioneer them as leader of a coalition of ranchers and conservationists."--Gus Speth, author of Angels by the River and former dean at Yale School of Forestry and Environmental Studies

“Taking soil seriously offers real leverage in the climate change battle. For those who eat (or raise) meat, Two Percent Solutions for the Planet offers fascinating new insights about animal agriculture. For those who eat lower on the food chain, Courtney White details dozens of other ways to help restore the degraded landscapes that, sadly, dominate much of our planet.”--Bill McKibben, author of Deep Economy

“An excellent read and source of ideas for farmers anywhere. With agriculture today producing twenty times as much dead, eroding soil as food required per human each year, it is time to return to farmer creativity. Courtney White’s book shows us how creative and observant farmers and ranchers are finding solutions to many of the most challenging problems we face.”--Allan Savory, president of Savory Institute and chairman of the Africa Centre for Holistic Management

Reviews and Praise

Foreword Reviews-

"Two Percent Solutions for the Planet takes a clever approach to environmental problems. Rather than look at overarching solutions, Courtney White compiles fifty examples of effective, relatively small-scale success stories from around the world—all of which have made a positive impact on the environment and climate. In one example, he looks at the use of beetles to quickly turn manure into fertilizer. He describes an Australian farm’s experience grazing cattle alongside sheep, replenishing the land while simultaneously raising the animals on a healthy grass diet. Another project involved using natural materials like sticks and stones to improve a creek’s flow. The fifty examples show a nice range of innovative solutions that can be replicated, with results that benefit the planet as well as a specific farm, ranch, or other piece of land. The book’s title comes from the notion that all these solutions could be implemented for a tiny fraction of GDP, and each of the fifty examples includes links and resources for additional information about how to implement them."

Shelf Awareness-

"Eliminating pesticides, sequestering carbon, making healthy food available to the poor and harvesting rainwater are some of the many positive goals of the 50 regenerative practices Quivira Coalition co-founder Courtney White (The Age of Consequences) outlines in Two Percent Solutions for the Planet. White organizes these green ideas into five sections--ranching, farming, technology, restoration and wildness--includes pictures and charts to help illustrate and provides information on how readers can learn more about each concept. The common theme underlying them all, however, is 'nature knows best.' Including organic no-till, year-round farming, flerds (the co-existence of range animals) and 'poop 'n’ stomp' (using livestock to regrow grass), the solutions return the work to natural processes. White believes, 'sometimes innovation isn't a thing, a practice, or a new technology, but simply a different way of looking at the world.’ While Two Percent Solutions for the Planet would make an excellent resource for any agri-science program, it's also an enlightening reading experience for city dwellers and others far from agrarian lifestyles. Understanding processes described in the book can inform buying decisions, community involvement, even backyard gardening practices--all of which can help combat some of the world's most pressing environmental issues while simultaneously treating the planet with kindness and respect. Two Percent Solutions for the Planet is easy to understand, fascinating and enjoyably educational. Whether readers are entrenched in agricultural business or simply interested in sustainability, there's plenty to glean from White's collection of innovative practices.”

Publishers Weekly-

"In this brief work, White (The Age of Consequences), conservationist and cofounder of the Quivira Coalition, sketches 50 strategies for improving the environment and fighting hunger. Few of these strategies are aimed at the planet’s urbanized majority; while chapters dealing with rooftop gardens or aquaponics may inspire city-dwellers, most of the four-page chapters give short overviews of tactics that will primarily be useful to farmers, ranchers, and policymakers who deal directly with the land. White repeatedly refers to the writings of Aldo Leopold and is also fond of creek reclamation specialist Bill Zeedyk, who urges those attempting to restore watersheds to 'think like a creek.' White stresses the importance of improving the quality of watercourses and the ability of soil to retain carbon, thus mitigating climate change. The section ‘Wildness' addresses a range of wildlife, including such different creatures as the dung beetle and the beaver. Since each solution receives swift treatment, White isn’t able to give detailed instructions, but each segment includes online and print resources for further reference. White offers a good starting place for agriculturalists looking for ways to improve their farms and ranches, as well as the larger environment. Color photos.”

“Courtney White chronicles a new and critically important sphere of knowledge: a world of soil, sun, sky, and animals where good people regenerate the earth in ancient and novel ways. Reading about the environment rarely brings one as many smiles and as much joy as Two Percent Solutions for the Planet.”--Paul Hawken, author of Blessed Unrest; coauthor of Natural Capitalism

“Courtney White has written one of the most important books for our time about how to reverse climate change and nourish the world with abundant, healthy food. Most importantly, he describes proven, ‘shovel-ready’ solutions that progressive ranchers and farmers are doing every day. There is no need to spend billions of dollars on new, unproven technologies such as carbon capture and geoengineering. For a fraction of the cost, the world easily could scale up the regenerative practices profiled in Two Percent Solutions for the Planet. Too good to be true? Read this book and make up your own mind.”--André Leu, president of IFOAM-Organics International and author of The Myths of Safe Pesticides

“The problems that humanity faces today are the sum total of billions of small missteps. Courtney White focuses on the solutions that will arise from billions of small right steps, and the most important step is the next one that each of us takes. We may never convince seven billion souls to plant one tree at a time, over and over for the rest of their lives, but each one of us can make that commitment if we choose. Two Percent Solutions for the Planet shows us a broad pattern for healing the earth that is elegant in its simplicity. We can reforest our world, restore grasslands, sequester carbon, build soil, purify water, provide wildlife habitat, feed humanity, and improve health and nutrition while creating the ecological abundance of the future. Bravo, Courtney!”--Mark Shepard, author of Restoration Agriculture

“Courtney White’s Two Percent Solutions for the Planet features good sense paired with 50 solutions to our planet’s ills, especially those related to carbon. While each solution could be a book in itself, these short profiles may well be the way many people first discover that such solutions are in the offing. It’s a brilliant way to inform readers so that they’ll prick up their ears when they encounter possible actions based on solutions such as these. This accessible, hope-filled, and beautifully crafted book should be in every school—if not simply everywhere.”--Deborah Madison, author of Vegetable Literacy

"Courtney White takes a sharp turn away from despair over climate disruption and toward the inexorable logic of ecosystem restoration—working with nature to bring the carbon and water cycles back into balance, thereby addressing the central challenges of our time. Along the way he introduces readers to a spirited cast of farmers, ranchers, thinkers, and tinkerers. The lively profiles of innovators show us what’s possible; Courtney’s narration tells us why this matters. I dare anyone to read this book and not come away feeling hopeful and energized!”--Judith D. Schwartz, author of Cows Save the Planet

“This book is Courtney White’s most important work. It is the best practical guide to how we can begin to address the significant, unavoidable challenges awaiting us in our not-too-distant future. Two Percent Solutions for the Planet inspires us to address these challenges creatively, especially with respect to our food and agriculture future, and to do it in cooperation with nature in ways that also heal the planet. The solutions Courtney describes are not just ideas but are demonstrated strategies already being implemented by creative farmers, ranchers, ecologists, and designers. This book is a must-read for anyone interested in practical ways to restore the planet’s health while experiencing a flourishing life.”--Frederick Kirschenmann, author of Cultivating An Ecological Conscience: Essays From a Farmer Philosopher

"The two percents really add up in this glorious presentation of how to make ranching, agriculture, and the great outdoors a major force for addressing our gravest threat: climate change. Courtney White truly knows these solutions, having helped pioneer them as leader of a coalition of ranchers and conservationists."--Gus Speth, author of Angels by the River and former dean at Yale School of Forestry and Environmental Studies

“Taking soil seriously offers real leverage in the climate change battle. For those who eat (or raise) meat, Two Percent Solutions for the Planet offers fascinating new insights about animal agriculture. For those who eat lower on the food chain, Courtney White details dozens of other ways to help restore the degraded landscapes that, sadly, dominate much of our planet.”--Bill McKibben, author of Deep Economy

“An excellent read and source of ideas for farmers anywhere. With agriculture today producing twenty times as much dead, eroding soil as food required per human each year, it is time to return to farmer creativity. Courtney White’s book shows us how creative and observant farmers and ranchers are finding solutions to many of the most challenging problems we face.”--Allan Savory, president of Savory Institute and chairman of the Africa Centre for Holistic Management