| Playtime: | 122 minutes |

| Size: | 7.5 x 5.25 inch |

| Publisher: | Chelsea Green Publishing |

| Pub. Date: | June 22, 2012 |

| ISBN: | 9781603582452 |

Also available in:

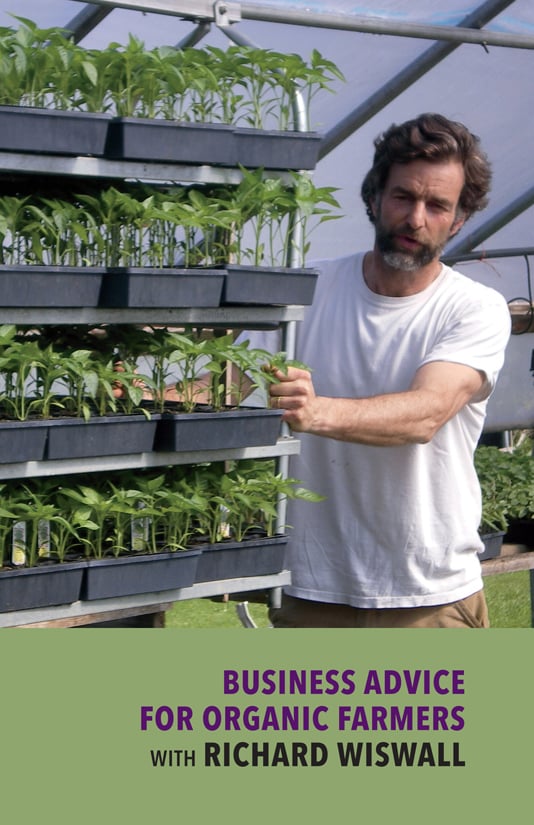

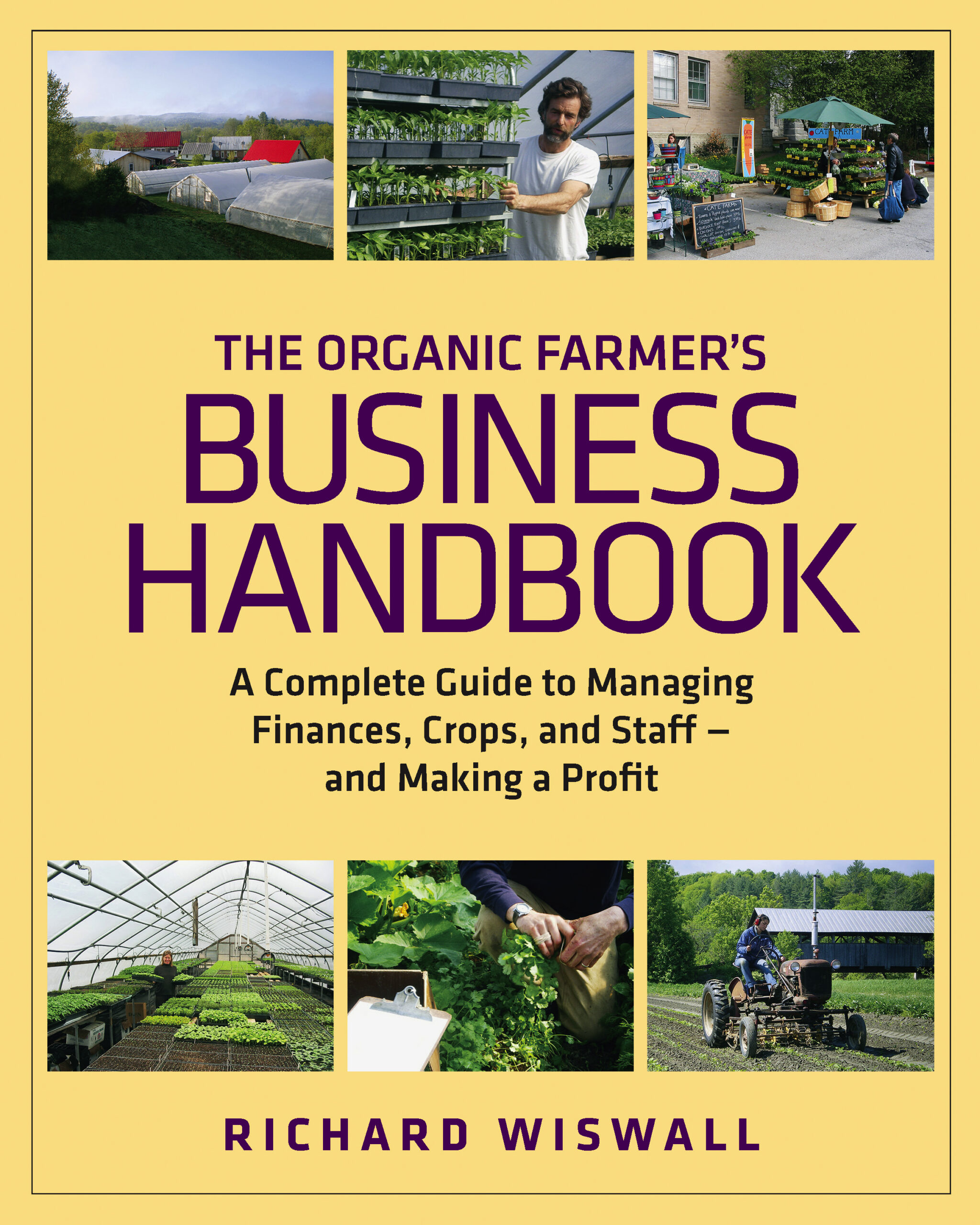

Business Advice for Organic Farmers with Richard Wiswall (DVD)

Contrary to popular belief, a good living can be made on an organic farm. What’s required is farming smarter, not harder.

In this filmed workshop and interview, recorded at the Northeast Organic Farming Association (NOFA) Winter Conference in 2010 and at Cate Farm, longtime farmer Richard Wiswall shares his story, and offers detailed advice on how to make your farm production more efficient, better manage your employees and finances, and turn a profit.

From his thirty years of experience at Cate Farm in Vermont, Wiswall knows firsthand the joys of starting and operating an organic farm – as well as the challenges of making a living from one. Farming offers fundamental satisfaction from producing food, working outdoors, being one’s own boss, and working intimately with nature. But, unfortunately, many farmers avoid learning about the business end of farming, and because of this, they often work harder than they need to, or quit farming altogether because of frustrating – and often avoidable – losses. This workshop offers invaluable exercises for business-savvy farmers, including information on the costs of running a farm, office and bookkeeping management, creating a budget and crop enterprise plan, and getting down the the nuts and bolts of business management, that’s easy to understand.

Through in-the-classroom footage and step-by-step guidance to “sharpening the pencil”, as well as footage of Wiswall’s fields, greenhouse, and barn, viewers will leave this “workshop” knowing how to achieve true profit, that will last for years to come. Also included is a bonus disc with downloadable spreadsheets for creating your own budget, marketing, profit and loss statement, balance sheet, and cash flow.