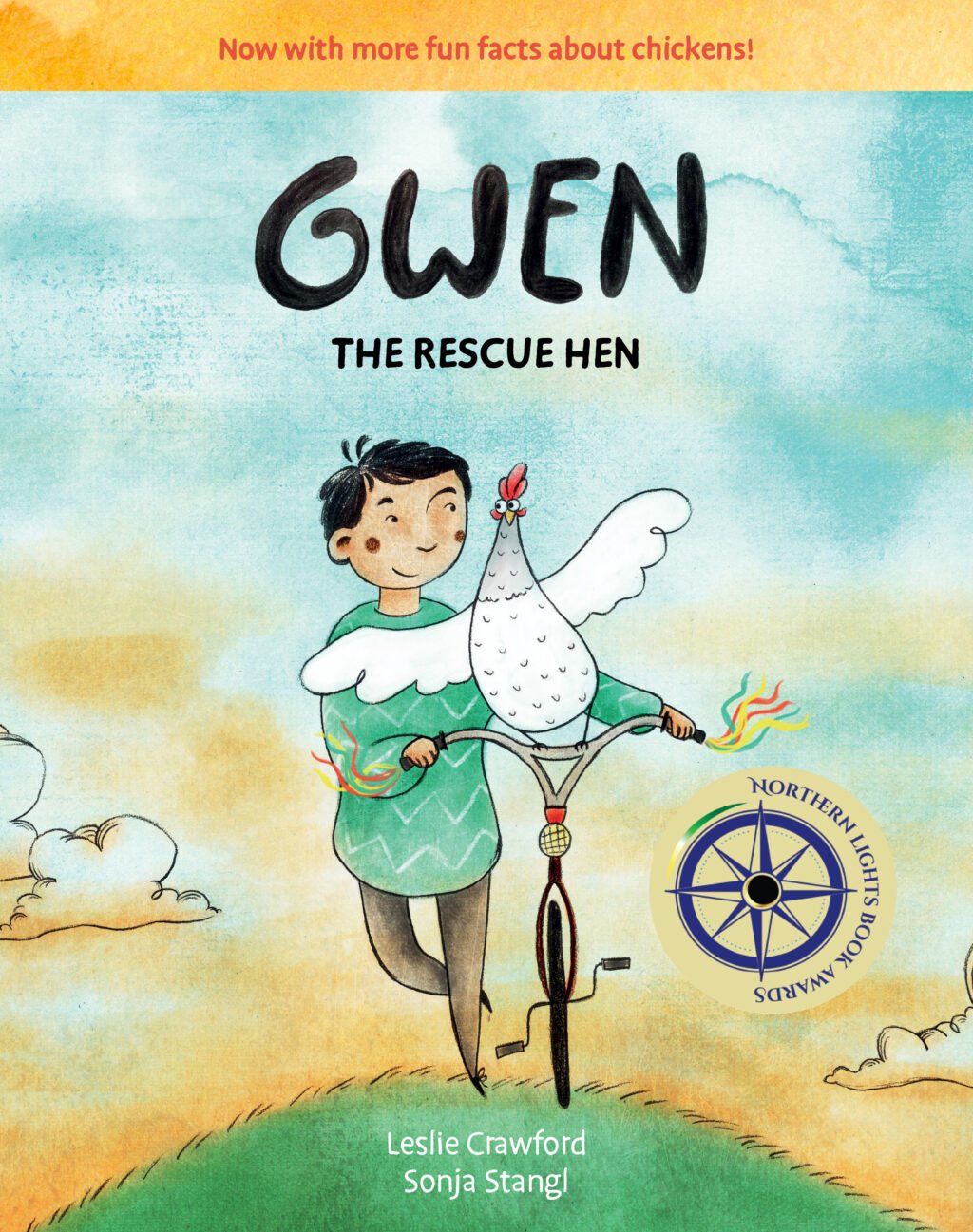

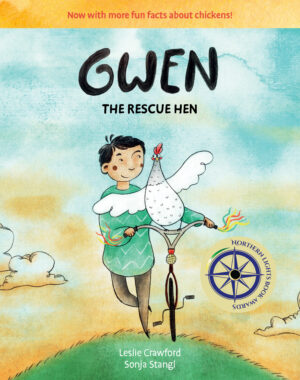

Gwen the Rescue Hen

*Winner of the 2020 Northern Lights Book Award Honoring Children’s Literature of Exceptional Merit

PACKED with 22 fun facts about chickens!

Gwen the Rescue Hen is the heart-warming story of a quick-witted chicken who discovers the joy of being a hen after she’s sprung from an egg-laying farm, and finds her way to a boy named Mateo.

Gwen has spent her whole life in a big egg-laying hen house, so she knows very little about what chickens can do (besides lay eggs, of course). A fateful tornado turns her world upside-down and sideways, landing her in a strange new place that’s nothing like the hen house.

Using her wits and chicken superpowers, Gwen dodges danger at every turn until she finds safety and friendship with a boy named Mateo. Together they discover how extraordinary an ordinary chicken really is.

The book includes a bonus section called More About Chickens, where curious readers can learn that chickens have extraordinary eyesight, a complex language of 24 sounds, and are descended from dinosaurs, among other fun facts about chickens.

Reviews and Praise

Raise Vegan—

"Another compelling title by children’s book author Leslie Crawford, Gwen the Rescue Hen is a treat for the heart and the eyes alike. This uplifting story follows a very special hen as she escapes industrial agriculture to her eventual meeting of Mateo, a compassionate kid who comes to be her closest friend. Smashing boundaries between human and nonhuman animals, this book is a true heart opener for anyone with a soft spot for our furry and feathered friends."

More Reviews and Praise

Kirkus Reviews–

Chickens in a factory farm get an unexpected chance at a better life. Crammed into a tiny cage, with hardly any room to move, Hen longs to stretch her wings and fly. But like the other chickens in the cages that line the pitch-black barn, she is part of an egg farm, so the only flying she can do is in her dreams. Suddenly a roaring sound fills the air ("HOWOOOOH!"). A tornado rips the roof off of the barn ("KABOOM!") and takes Hen's cage swirling with it. When she touches down ("CLONK!"), she is amazed to see a world of color and tasty grass. But there are also new dangers to fear: barking dogs and zooming motorcycles. Luckily she meets Mateo, a tan-skinned, brown-haired boy who has a penchant for chickens. Mateo renames Hen "Gwen" and learns to care for her and her friends, whom he finds and brings home. Readers will happily learn along with Mateo, using the intriguing list of chicken facts appended at the end. Stangl's teardrop-shaped fowl further endear as they peer out from the pages with big eyes and bobbling bodies. With a light touch (and much onomatopoeia), Crawford offers compassion and insight on farm-animal rescues. (Picture book. 4-8)

"In telling these heartwarming tales of resilience, compassion and love, Crawford avoids the more brutal realities of factory farming, showing simply that these farms are extremely unhappy places for such intelligent and emotional beings. She focuses instead on how truly wonderful these overlooked and poorly treated animals are—that they're way more than just bacon and nuggets."—Reynard Loki, Ecowatch

"A gentle first entry into animal rights that will inspire young readers to think critically about the meat we consume and how farm animals are treated."—School Library Journal

"Gwen shows children, and adults that "happily ever after" is a real thing—and making it happen can be as simple as letting chickens live like chickens."—Randy Graham

"I’ve always said there are more reasons to raise backyard chickens than just getting fresh eggs – as good as that reason may be. Three other great reasons – to promote humane food production, to educate children about animals, and to have wonderful family pets – are explored in this delightful children’s book, Gwen the Rescue Hen."–Deb Neyens, Counting My Chickens blog

"Our society has long needed more kid-appropriate, high-quality media that gives them access to pro-animal stories in a compelling, age-appropriate way. Gwen the Rescue Hen does just that, allowing young readers to follow along as this darling chicken goes on the adventure of a lifetime thanks to a sudden twist of fate. Her story safely allows young readers to ask important questions about humans' relationships to animals, and the stunning illustrations allow readers to stay fully engaged. I have no doubt this book will quickly become your kid's favorite nighttime read."–Jasmin Singer, co-host of the "Our Hen House" podcast, Senior Editor of VegNews Magazine

“Do we ever really think much about the chicken, or the egg? We should! Gwen the Rescue Hen asks us to really see chickens and understand their unique kind of intelligence and their superpowers. Told with humor, insight, and compassion, and beautifully illustrated, Gwen uses her wits to find her way to a new life in which she can be the chicken she was meant to be.”–Brian Kateman, Editor of The Reducetarian Solution and The Reducetarian Cookbook

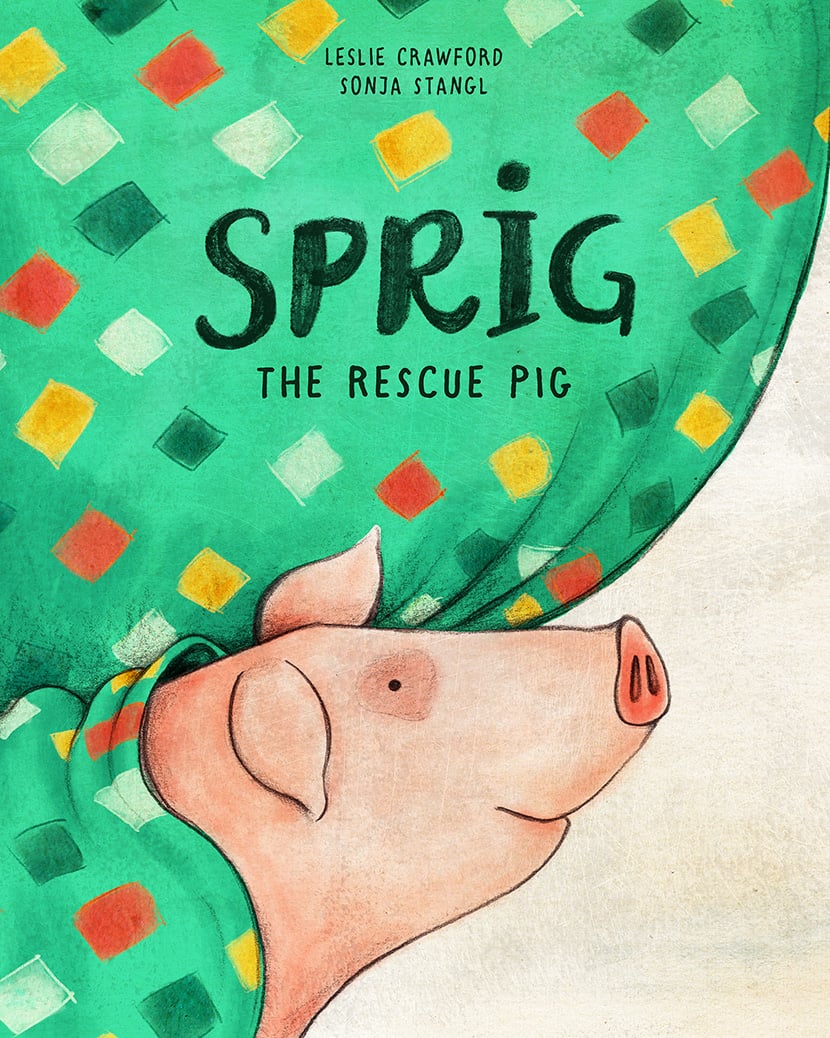

"Your books, Sprig the Rescue Pig and Gwen the Rescue Hen, are wonderful. Bravo! I can’t wait to see them in every kid’s hands."—Kathy Freston, bestselling author

"The writing was immediately captivating and left me wanting to find out what happened to Gwen."—The Book Horde

"Gwen’s story safely allows young readers to ask important questions about humans' relationships to animals, and the stunning illustrations keep readers fully engaged. I have no doubt this book will quickly become your kid's favorite nighttime read."—Veg News

Reviews and Praise

Raise Vegan—

"Another compelling title by children’s book author Leslie Crawford, Gwen the Rescue Hen is a treat for the heart and the eyes alike. This uplifting story follows a very special hen as she escapes industrial agriculture to her eventual meeting of Mateo, a compassionate kid who comes to be her closest friend. Smashing boundaries between human and nonhuman animals, this book is a true heart opener for anyone with a soft spot for our furry and feathered friends."

Kirkus Reviews–

Chickens in a factory farm get an unexpected chance at a better life. Crammed into a tiny cage, with hardly any room to move, Hen longs to stretch her wings and fly. But like the other chickens in the cages that line the pitch-black barn, she is part of an egg farm, so the only flying she can do is in her dreams. Suddenly a roaring sound fills the air ("HOWOOOOH!"). A tornado rips the roof off of the barn ("KABOOM!") and takes Hen's cage swirling with it. When she touches down ("CLONK!"), she is amazed to see a world of color and tasty grass. But there are also new dangers to fear: barking dogs and zooming motorcycles. Luckily she meets Mateo, a tan-skinned, brown-haired boy who has a penchant for chickens. Mateo renames Hen "Gwen" and learns to care for her and her friends, whom he finds and brings home. Readers will happily learn along with Mateo, using the intriguing list of chicken facts appended at the end. Stangl's teardrop-shaped fowl further endear as they peer out from the pages with big eyes and bobbling bodies. With a light touch (and much onomatopoeia), Crawford offers compassion and insight on farm-animal rescues. (Picture book. 4-8)

"In telling these heartwarming tales of resilience, compassion and love, Crawford avoids the more brutal realities of factory farming, showing simply that these farms are extremely unhappy places for such intelligent and emotional beings. She focuses instead on how truly wonderful these overlooked and poorly treated animals are—that they're way more than just bacon and nuggets."—Reynard Loki, Ecowatch

"A gentle first entry into animal rights that will inspire young readers to think critically about the meat we consume and how farm animals are treated."—School Library Journal

"Gwen shows children, and adults that "happily ever after" is a real thing—and making it happen can be as simple as letting chickens live like chickens."—Randy Graham

"I’ve always said there are more reasons to raise backyard chickens than just getting fresh eggs – as good as that reason may be. Three other great reasons – to promote humane food production, to educate children about animals, and to have wonderful family pets – are explored in this delightful children’s book, Gwen the Rescue Hen."–Deb Neyens, Counting My Chickens blog

"Our society has long needed more kid-appropriate, high-quality media that gives them access to pro-animal stories in a compelling, age-appropriate way. Gwen the Rescue Hen does just that, allowing young readers to follow along as this darling chicken goes on the adventure of a lifetime thanks to a sudden twist of fate. Her story safely allows young readers to ask important questions about humans' relationships to animals, and the stunning illustrations allow readers to stay fully engaged. I have no doubt this book will quickly become your kid's favorite nighttime read."–Jasmin Singer, co-host of the "Our Hen House" podcast, Senior Editor of VegNews Magazine

“Do we ever really think much about the chicken, or the egg? We should! Gwen the Rescue Hen asks us to really see chickens and understand their unique kind of intelligence and their superpowers. Told with humor, insight, and compassion, and beautifully illustrated, Gwen uses her wits to find her way to a new life in which she can be the chicken she was meant to be.”–Brian Kateman, Editor of The Reducetarian Solution and The Reducetarian Cookbook

"Your books, Sprig the Rescue Pig and Gwen the Rescue Hen, are wonderful. Bravo! I can’t wait to see them in every kid’s hands."—Kathy Freston, bestselling author

"The writing was immediately captivating and left me wanting to find out what happened to Gwen."—The Book Horde

"Gwen’s story safely allows young readers to ask important questions about humans' relationships to animals, and the stunning illustrations keep readers fully engaged. I have no doubt this book will quickly become your kid's favorite nighttime read."—Veg News